At its core, personal finance is about financial planning — crafting a budget, using money effectively, and making decisions that safeguard your financial security and contribute to your future prosperity.

It’s a crucial skill set that directly affects your ability to plan, protect, and grow your resources over time.

This article aims to equip you with a comprehensive grasp of the importance of personal finance, highlighting its pivotal role as the foundation for a stable and thriving future.

Key Takeaways

Personal finance encompasses managing a spending account, household debt, savings, borrowing money, and investment idea, emphasizing budgeting, estate planning, and retirement preparations to secure one’s financial future.

Learning about personal finance is essential because it helps you make smart choices with your money that can lead to a secure and prosperous life.

Knowing who you are and what you want helps you in making a simple budget, saving for tough times, thinking about old age, having health coverage, handling bills, making smart investment choices, and using tools that help keep track of your cash.

What is Personal Finance

Personal finance encompasses the total administration of your fiscal operations. It involves planning and managing activities such as income generation, spending, saving, and protection.

Think of it as a roadmap that guides you through your financial journey, helping you make informed decisions and plan for the future. This includes key activities such as budgeting, banking, insurance, mortgages, investments, retirement planning, tax, and estate planning.

Financial planning is an essential aspect of personal finance, ensuring a secure future for you and your family. That’s why personal finance important in our lives.

The core aspects of personal finance skills are:

Handling income

Managing expenses

Saving money

Making investments

The allocation of income towards expenses, savings, investments, and protection is a crucial part of this process. Your income can come from various sources, such as salaries, wages, dividends, and other types of cash inflow.

Income Management

Managing your income effectively is a fundamental step towards financial success. It all starts with knowing your precise take-home pay after taxes.

This knowledge is critical for making informed financial decisions. But what if your income isn’t enough to cover your expenses or achieve your financial goals? This is where additional income sources come in handy.

You can increase your income through various methods, such as working overtime, selling unused items, or taking on a second job. These strategies can help address financial troubles and improve your overall financial health.

Remember, every little bit helps, and additional income sources can make a significant difference in your financial situation.

Expense Control

Controlling your expenses is another critical component of personal finance. It ensures that your expenses do not exceed your income and helps prevent debt accumulation.

It’s vital to practice smart income allocation by recognizing the difference between essential needs and optional wants. Mastering this skill is a stepping stone to setting and achieving your financial aspirations in the future.

One effective strategy for reducing financial strain and contributing to debt reduction is cutting back on non-essential spending. This can be achieved by critically assessing your monthly expenses. Common categories of expenses include:

Housing

Food

Transportation

Discretionary purchases

The Importance of Personal Finance Education

Personal finance education is a cornerstone of financial success. It equips individuals with the knowledge and skills necessary to navigate the complex world of finance.

Educating oneself about personal finance is key to achieving financial success by making well-informed decisions related to budgeting, saving, and investing.

From a young age, personal finance education sets a strong foundation for financial well-being and securing a prosperous future. Moreover, understanding and managing personal finances effectively can:

Reduce stress and anxiety about financial uncertainties, contributing to better mental health

Help individuals make informed financial decisions

Improve financial literacy and confidence in managing your money

Enable individuals to set and achieve financial goals

Provide a sense of control and empowerment over one’s financial situation

Benefits of Financial Literacy

Financial literacy is more than just understanding how money works. It’s about understanding financial concepts and products, and being able to use this knowledge to make sound financial decisions. It equips you with the ability to:

Distinguish between good and bad financial advice

Navigate the complex world of personal finance

Budget effectively and manage your money

Save and invest wisely

Understand and manage debt

Plan for retirement and other long-term financial goals

Having financial literacy is crucial in today’s world filled with a plethora of financial information.

Armed with financial literacy, you are better equipped to make informed choices that help avoid costly mistakes, prepare for emergencies, and achieve personal financial goals with confidence.

It’s like having a compass guiding you through your financial journey, helping you navigate the complex world of money management with ease and assurance.

The goal is to know what you want from life and create a blueprint to help you navigate the journey and reach your goals.

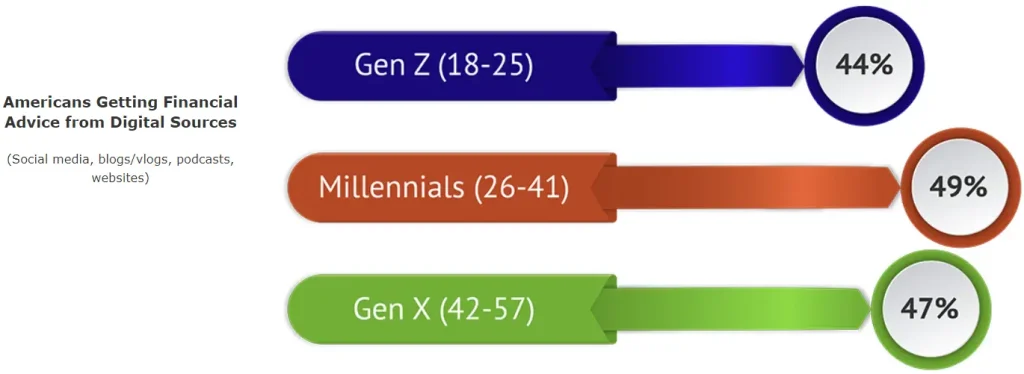

Sources of Personal Finance Education

So, where can one acquire personal finance education? There are several sources available today, including:

Podcasts

Online content

Government-sponsored programs

These resources provide a range of options for financial education, including courses, articles, tutorials, and interactive financial tools.

In addition, educational institutions such as schools and colleges, as well as specific educational initiatives, offer structured courses that focus on money management, economics, and the principles of personal finance.

Getting together with friends or joining local groups can be a warm and friendly way to learn simple tips for managing your money and finding out about handy financial tricks.

Key Components of Personal Financial Management

To successfully manage your personal finances, there are a few key components you need to focus on. These include:

Creating a budget

Managing savings

Monitoring your credit

Taking measures to protect against unforeseen events

By mastering these money management skills, you can ensure a stable and secure financial future.

These aspects are the building blocks of your financial stability and security.

Creating a budget is identified as the first step in managing personal finances, leading to the development of a formal financial plan.

Monitoring one’s credit regularly helps ensure accuracy in debts and prevents unrecognized accounts, which is vital for financial health.

Incorporating a plan to pay bills on time is an essential aspect of maintaining a strong financial foundation.

Personal protection in finance refers to measures taken to guard against unforeseen and adverse events, safeguarding one’s financial situation.

Budgeting for Success

Budgeting is the foundation of effective personal financial management. It is the first step towards building a strong financial foundation. It’s not trying to penny-pinch through life, but having a game plan for how you treat your funds.

Developing a detailed budget empowers individuals to manage expenses effectively and move towards saving and investing.

Creating a budget is integral to establishing healthier money habits and gaining control over personal finances. Your budget can uncover spending patterns and necessitate adjustments to allocate funds towards long-term savings goals such as purchasing a car or funding home improvements.

Some budgeting models suggest saving 20% of after-tax income in a savings account, striking a balance between needs and wants to support longer-term financial ambitions.

Building an Emergency Fund

Unexpected expenses can arise at any time. Building an emergency fund is crucial to cover these unforeseen financial challenges and minimize the need to rely on credit.

An emergency fund should typically hold three to six months’ worth of living expenses to adequately cover unexpected events without compromising other financial goals.

Using funds from an emergency account can prevent the accumulation of new debt when facing unexpected financial difficulties.

By incorporating realistic and achievable goals for an emergency fund within a budget, you can build financial security over time.

Retirement Planning

Retirement might seem far off, but it’s never too early to start planning. Retirement planning is essential for securing financial well-being in your later years.

Incorporating retirement savings as a fixed expense in a well-maintained budget supports the consistent growth of a retirement fund.

Understanding the different types of retirement accounts and their associated tax implications is vital for effective retirement planning.

It’s generally recommended to save 15% of your pretax income for retirement, which should include both individual contributions and employer matching where available.

Effective Strategies for Managing Personal Finances

Managing personal finance can seem daunting, but with the right strategies in place, it becomes a lot more manageable. Effective strategies for managing personal finances include reducing and managing debt, investing wisely, and utilizing financial tools and apps.

Setting attainable financial targets while allowing for occasional indulgences can help sustain motivation and curb excessive spending.

Investing involves purchasing assets with the expectation of earning returns, though not all investments yield a positive rate of return due to inherent risks.

Reducing and Managing Debt

Financial freedom can be challenging to achieve when burdened by significant debt. It can hinder one’s ability to save and invest for the future.

Therefore, reducing and managing debt is an essential component of personal financial management. To reduce debt, identifying the most financially burdensome debts and choosing a debt reduction strategy aligned with your personal financial goals is essential.

Strategies such as the snowball method and the debt avalanche method can assist in paying off debts more systematically and effectively.

High-interest debts, like credit card debts, can have a significant financial impact, so using credit cards wisely is integral to reducing overall financial strain.

Investing Wisely

Investing wisely is crucial for growing wealth and achieving long-term financial stability. Financial literacy plays a key role in this, equipping individuals with essential skills for managing money more effectively.

Understanding the importance of saving and investing is a key component of financial literacy, enabling individuals to grow their wealth and achieve long-term financial stability. But remember, investing is not without its risks.

Therefore, it’s important to make informed investment decisions based on your financial goals and risk tolerance.

Utilizing Financial Tools and Apps

In today’s digital age, managing finances has become much easier thanks to a range of financial tools and apps. Using such tools can simplify financial management and support users in making informed decisions.

Whether it’s tracking expenses, budgeting, managing investments, or planning for retirement, there’s probably an app for that. These tools can simplify the process and help you stay on top of your finances.

Overcoming Common Personal Finance Challenges

Even with all the knowledge and tools at our disposal, we may still encounter challenges in managing our personal finances.

Common challenges include balancing savings and spending, managing unexpected expenses, and dealing with financial stress.

However, with the right strategies and a proactive approach, these challenges can be overcome. This includes developing financial literacy, setting attainable financial targets, and utilizing financial tools and apps to make informed decisions.

Balancing Savings and Spending

Balancing savings and spending is a common challenge many of us face. It’s essential to ensure financial stability without compromising the enjoyment of life.

Effective budgeting is a critical method to control and monitor spending.

Smart spending choices fostered by budgeting methods such as the envelope system can enable individuals to enjoy life while saving money.

Remember, it’s all about finding a balance that works for you and aligns with your financial goals.

Managing Unexpected Expenses

Life is full of surprises, and not all of them are pleasant. Unexpected expenses can arise at any time, such as health insurance costs, and being financially prepared is crucial to avoid derailing your financial plans.

A proactive strategy to manage unexpected expenses is to:

Dedicate a segment of your earnings each month

This can help cover small, unplanned expenses like repair costs or unexpected social events

Remember, a little preparation can go a long way in maintaining your financial stability.

Summary

In conclusion, mastering personal finance is not just about numbers—it’s about making informed decisions that lead to financial stability and security. These decisions are easily made when you know your future goals and dreams.

This guide has taken you through a comprehensive journey, from grasping the essentials of personal finance and recognizing the significance of financial education, to exploring the fundamental elements of managing your finances and the strategies that can enhance your financial handling skills.

Remember, overcoming common personal finance challenges is possible with the right knowledge and tools at your disposal. So, here’s to your financial success!

Frequently Asked Questions

What are the 5 basics of personal finance?

The 5 basics of personal finance include saving, investing, financial protection, tax planning, and retirement planning.

It is crucial to prioritize spending less than you earn, maximizing your income, planning for emergencies, building credit, and saving for retirement. Understanding and managing income, spending, savings, investing, and protection are fundamental in personal finance.

What does personal finance teach us?

Personal finance teaches us essential skills and practices to plan for the future and understand the impact of today’s financial decisions on tomorrow.

It covers managing expenses, saving, investing, and planning for retirement.

What is the meaning of personal finance?

Personal finance refers to managing individual and family finances, including budgeting, saving, and setting financial goals to address various risks and future life events.

It also involves handling financial tasks and saving for emergencies.

Why are personal finances important?

Personal finances are important because they allow you to make well-informed decisions about investments, loans, and other financial products, leading to better financial outcomes.

Why is personal finance education important?

Personal finance education is important because it provides the knowledge and skills needed to make informed financial decisions, leading to greater financial success.