People often think about insurance as a necessary evil – something you’re required to have but hope you never need. But, insurance is a lot more than that. It’s about planning, securing your future, and having a safety net for yourself and those you care about.

It’s about protecting yourself from the unpredictable nature of life, be it an unexpected accident, a sudden illness, or a natural disaster. This means it’s crucial to know what type of coverage you need and how to choose the right policy that fits your unique situation.

Table Of Contents:

- Understanding the World of Insurance

- Why Get Insurance

- Understanding Your Needs

- How to Choose the Right Policy

- Making a Claim

- Conclusion

Understanding the World of Insurance

Navigating the different types of insurance can feel a bit overwhelming, especially if you’re new to this. Let’s break it down a bit.

Types of Insurance

Insurance can cover almost every aspect of your life. Here are some of the most common types you’ll likely encounter:

Health Insurance: A must-have to protect you and your family from unexpected medical costs. You can pick from various plans like HMOs and PPOs, based on your needs.

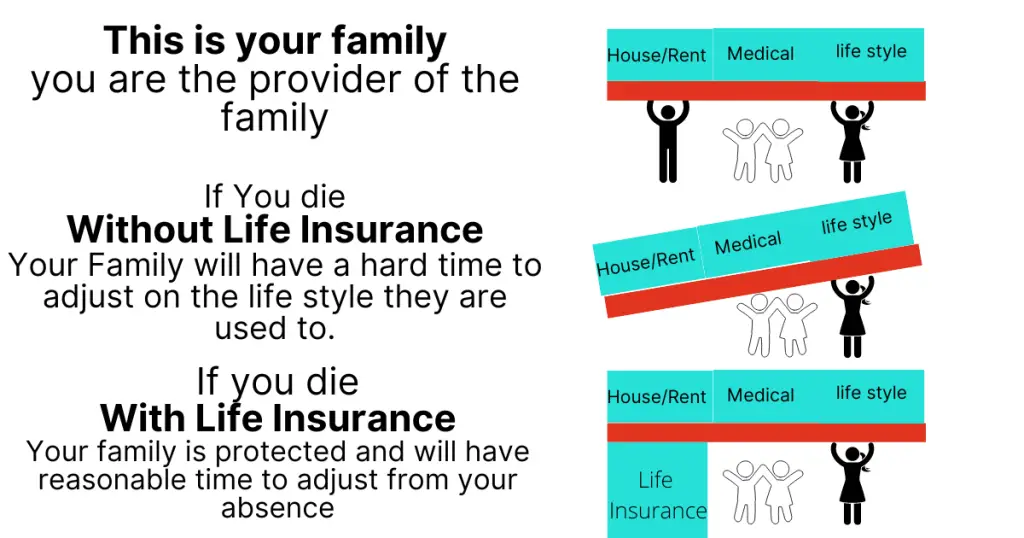

Life Insurance: While we might not like to think about it, this provides financial security for your family if something happens to you. Types of life insurance coverage vary from term to whole life – an insurance professional can help you determine what’s best for you.

Auto Insurance: Required in most states, this protects you in case of accidents, theft, or damage to your car. Additional protection is a good idea because sometimes the minimum required auto insurance by law isn’t enough. Even if your driving record is pristine, accidents can happen.

Homeowners/Renters Insurance: Protects your belongings from theft, fire, or natural disasters. If you own your place, a homeowners policy is what you’ll need, whereas renters insurance protects you in a rented home or apartment. Condo renters would want to explore insurance coverage for their needs as well.

Business Insurance: Protects businesses against a wide range of risks. Coverage varies by business and industry but can protect a business owner from theft, liability issues, or natural disasters impacting their business operations. When thinking about business insurance, business owners may have questions about the insurance products available. A licensed insurance agent should be able to answer any insurance questions a business may have.

Flood Insurance: Flooding can happen to anyone. It’s separate from a standard homeowners or renters insurance policy and crucial for those living in flood-prone zones. A lot of insurance providers participate in a Write-Your-Own (WYO) program offering flood protection to homeowners. The WYO program offers policies directly to homeowners or renters.

Don’t let this overwhelm you though, it just highlights how crucial this form of protection is in almost every area of your life. Insurance really is all about peace of mind. You can find useful information from a range of reputable insurance companies, like the many insurance resources offered on Liberty Mutual’s website.

Why Get Insurance

This may seem self-explanatory. But, with so many choices available, understanding the core value of getting covered is a key starting point. Choosing the right insurance can be difficult.

- Protection from Financial Risk: Think of insurance as a financial cushion. It shields you from major expenses related to accidents, disasters, illnesses, or unexpected events. An example of this would be if you had an unexpected illness and needed to go to the hospital, health insurance would help cover the costs.

- Meeting Legal Obligations: Sometimes, insurance isn’t just a good idea, it’s the law. This applies to things like car insurance and health insurance depending on your local regulations. In most states, you are required to have car insurance to legally drive a vehicle. If you are caught driving without insurance you may face fines or even jail time.

- : When unexpected things happen, dealing with the financial repercussions adds an extra layer of stress. Knowing you have insurance coverage to rely on helps you navigate challenges more easily. This is what we call security for life. Life insurance is also a way to help you plan for your family’s future.

Understanding Your Needs

The key is to assess your individual needs, lifestyle, and potential risks. Everyone has different needs when it comes to coverage.

- Assets: Think about what you need to protect – a car, house, or valuable items. The kind of insurance and the amount of coverage should be enough to help with any replacement or repair costs. An insurance agent can help with personal insurance planning. An insurance agent will ask questions about your assets in order to properly quote your needs.

- Health: If you’re frequently at the doctor or have family medical history concerns, understanding health insurance basics will help determine the right plan. You may find it useful to select a lower deductible plan or factor in regular copays to best suit your individual needs. Getting life insurance quotes are typically free and there’s no obligation to buy.

- Family: Life insurance plays an important role in protecting those that rely on you. Think about income replacement needs, college funding, or mortgage payoff to help calculate the appropriate level of coverage. You may be surprised at how life changes such as getting married, starting a family, or retiring, could shift your needs. Have you thought about investing in life insurance? Many people are seeking more than just a death benefit. Some people like to look at the investment opportunities of a permanent life insurance policy as part of their financial planning. They use life insurance as an investment to supplement their retirement savings and consider it part of their life insurance financial planning. These types of life insurance policies can be financed. Financed life insurance, also known as premium financing, utilizes a loan to cover the costs.

How to Choose the Right Policy

Now comes the important part – picking a plan that works for you. Group insurance is an insurance policy that covers a defined group of people, for example, the employees of one company, or members of a professional organization. Group life insurance is a common benefit offered by employers. Life insurance in business is an important aspect that is sometimes overlooked.

- Research and Compare: Research and compare insurance companies, policies, and premiums. You can even reach out to an independent insurance agent who can assist you in making the best decisions. It is advisable to get quotes from several different insurance companies. Getting insurance quotes will give you a chance to compare the rates, coverage options, and benefits.

- Read the Fine Print: Insurance can feel a bit confusing with all the technical jargon. It’s critical to review everything, understanding what’s included (and what isn’t) before signing on the dotted line. Ano ang life insurance?

- Understand the Terms: Familiarize yourself with insurance terminology – premiums, deductibles, coverage limits, and exclusions. Frequently asked questions are generally a good place to find basic explanations, but talking to an insurance professional ensures you’ll fully understand your policy.

- Ask Questions: It’s critical to communicate any concerns, request clarification on confusing parts, and make sure all your questions are fully addressed. Insurance professionals are experts on policies. You can rely on them to clearly explain complicated parts and make sure the plan is fully understood before signing. An insurance professional can help you set up a plan that aligns with your personal insurance planning.

Making a Claim

Having the right coverage can help put your mind at ease, but you also want to feel comfortable with your provider, should the time come to submit a claim. This is where your life insurance agent can really be helpful to guide you.

Stay Organized: Keep your policies, relevant documents, and contact info handy. Submitting a claim may feel confusing; having all this information in a central spot will speed things up. If you’re looking for how to start this process, Liberty Mutual has a helpful online claims center.

Document Everything: In the case of an accident, fire, or disaster documenting the details (with pictures, if relevant) provides support to your claims process. An example of this would be if you were in a car accident and took photos of the damage to your vehicle.

Keep Records: Holding onto all communication (phone calls, emails) from the insurance provider, as well as invoices from repair or replacement expenses, keeps the process moving smoothly. You can generally also follow up directly online; Liberty Mutual, for example, offers a simple online solution to manage your claim. The insurance company may ask you for receipts of costs associated with your claim so be sure to save them.

Conclusion

Getting insurance is a step toward taking control of your financial well-being. It is also important for safeguarding your assets and future. Selecting the right insurance may initially feel daunting, but breaking the process into small steps makes it a whole lot easier. And, once you’ve chosen your coverage, you can relax. After all, that’s really the true benefit of good insurance.

FAQ

What is a premium? This is the money you pay for your insurance policy, kind of like a subscription fee. It might be monthly, every six months, or even once a year.

And what’s a deductible? Think of this as your share of the costs if you need to use your insurance. Let’s say you have a $500 deductible on your car insurance, and you get into an accident that costs $3,000 to fix. You’d pay the first $500, and your insurance would cover the remaining $2,500.

What’s the deal with coverage limits? These are the maximum amounts your insurance will pay out for a covered claim. For example, your auto insurance policy might have a $50,000 bodily injury liability coverage limit per person. This means that’s the most they’ll pay if you’re found at fault for an accident that injures someone else.

How often should I review my insurance policies? It’s recommended to review your insurance policies at least once a year, or whenever you experience a major life change such as getting married, having a child, buying a home, changing jobs, or retiring. Life events can significantly impact your insurance needs. For instance, getting married might mean you need to combine policies or adjust beneficiaries, while buying a home requires homeowners insurance. Similarly, having a child often prompts a need for additional life insurance coverage. Regular reviews ensure your coverage amounts remain adequate and that you’re taking advantage of any new discounts you might qualify for, such as bundling policies or good driver discounts. Additionally, insurance rates and available coverage options can change over time, so periodic reviews help you determine if you could get better coverage or rates elsewhere. Setting an annual reminder to review your policies with your insurance agent or doing your own comparison shopping can help ensure you maintain appropriate protection while potentially saving money.

Can I have multiple insurance policies from different companies? Yes, you can absolutely have multiple insurance policies from different companies, and many people do. For example, you might have auto insurance with one company, homeowners insurance with another, and life insurance with a third. This approach allows you to shop for the best rates and coverage for each type of insurance independently. However, there are some considerations to keep in mind. Many insurance companies offer bundling discounts when you purchase multiple policies from them, such as combining home and auto insurance, which can result in significant savings. Before spreading your policies across multiple insurers, compare the bundled rates against individual policies from different companies to see which option provides better value. Additionally, having all your policies with one company can simplify management, as you’ll have a single point of contact for questions and claims. When you do have multiple insurers, make sure to keep detailed records of each policy, including coverage amounts, deductibles, and contact information. Also, be aware that if you have overlapping coverage (such as multiple life insurance policies), you’ll need to inform all insurers about your total coverage when applying for new policies, as this can affect underwriting decisions.