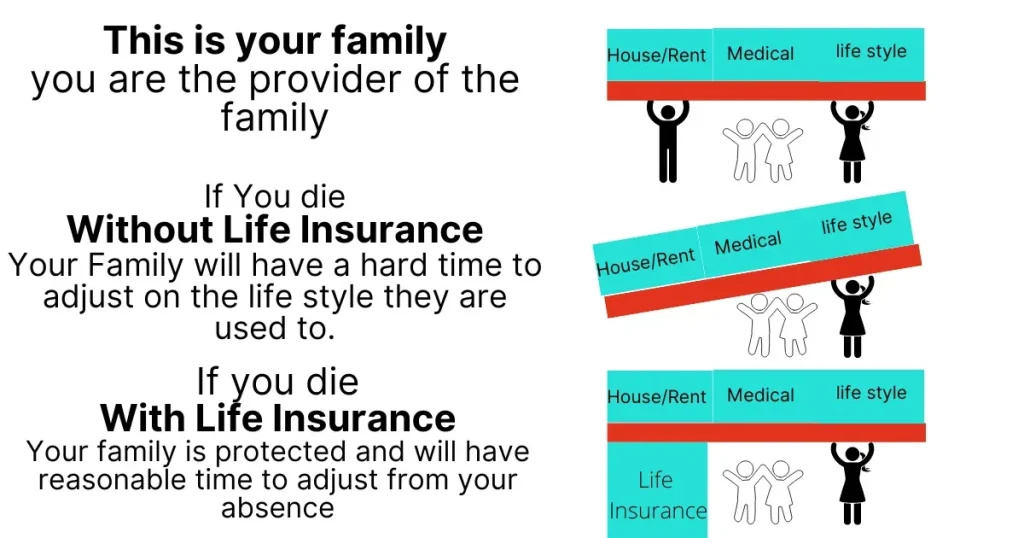

Life throws us curveballs. It’s easy to think about sunny days and smooth sailing, but what happens when a storm hits? That’s where life insurance steps in, providing a safety net for your loved ones if you’re no longer around. But with so many options, it can feel confusing. This is where we’re going to break down a specific type: permanent life insurance. We’ll explore the nuts and bolts so you can make informed decisions about your future.

Now, you might be thinking, “Isn’t all life insurance, well, permanent?” Not quite. While there are many life insurance options, we’re zeroing in on permanent life insurance, designed to cover you for, as you might have guessed, your whole life. But what is permanent life insurance exactly and how is it different? Let’s dive in and learn.

Table of Contents:

What is Permanent Life Insurance?

Unlike term life insurance, which covers you for a set period (like 10 or 20 years), a permanent life insurance policy sticks with you for as long as you live – provided you keep up with the premium payments. That means no matter when you pass away, your beneficiaries will receive a death benefit to help cover expenses like funeral costs, mortgage payments, or even future college tuition. Permanent life insurance provides lifelong coverage and combines a death benefit with a savings element that builds cash value.

The savings component earns interest on a tax-deferred basis, so you won’t have to pay taxes on it until you withdraw the funds. This cash value feature can be used for things like covering premium payments or even supplementing your retirement income. A permanent life insurance policy could be a good option if you’re looking for a guaranteed death benefit with a savings component.

Term Life Insurance vs. Permanent Life Insurance

Before we dive into the details of permanent life insurance, let’s compare it to its counterpart, term life insurance. Both have their place, so understanding the differences is essential to choosing the coverage that fits your situation.

|

Feature |

Term Life Insurance |

Permanent Life Insurance |

|

Coverage Length |

Temporary (typically 10, 20, or 30 years) |

Lifelong |

|

Premium Costs |

Generally lower than permanent life |

Higher than term life |

|

Cash Value |

No |

Yes |

|

Flexibility |

More flexible, can adjust coverage length |

Less flexible, lifelong commitment |

|

Death Benefit |

Paid out only if death occurs during the term |

Guaranteed payout to beneficiaries upon death |

If you’re primarily concerned with affordability and covering specific short-term needs (such as a mortgage), term life insurance could be the right fit. On the other hand, permanent life insurance makes sense for long-term financial goals, creating a lasting legacy, or as a tax-advantaged savings strategy. Determining whether the insurance cost of permanent coverage is right for you and your situation is an important step.

Types of Permanent Life Insurance

Permanent life insurance isn’t a one-size-fits-all product. There are a few varieties to understand. Before deciding if a permanent life insurance policy is right for you, you should carefully consider all your life insurance options and speak to a financial professional.

1. Whole Life Insurance

This is the most basic type of permanent life insurance. It provides a guaranteed death benefit, and your premiums remain level throughout the policy’s life. The cash value portion accumulates steadily at a guaranteed rate set by the insurance company.

2. Universal Life Insurance

Think of this type as having some flexibility. Universal life insurance also combines a death benefit and a savings element. It allows for adjustable premiums (within certain limits), so you might be able to lower your payments if needed. But be mindful. This could impact your death benefit or cash value if not managed carefully.

There are two subtypes of universal life insurance: indexed and variable. Be sure to understand all of the details of an insurance policy, such as the insurance terms and any additional cost you could incur before you commit.

a. Indexed Universal Life Insurance

Indexed universal life insurance links the growth of your cash value to a chosen market index (such as the S&P 500). Your cash value grows based on the performance of this index, offering the potential for higher returns, although growth isn’t always guaranteed. The index is reviewed periodically and it changes depending on the market.

b. Variable Universal Life Insurance

Variable universal life insurance gives you more direct control by allowing you to choose from various investment options, often similar to mutual funds, for your cash value. This means greater potential for higher growth but also more risk if the investments perform poorly.

Benefits of Permanent Life Insurance

Permanent life insurance offers several advantages:

- Guaranteed Death Benefit: Your beneficiaries are guaranteed to receive the death benefit, providing financial security and peace of mind for your loved ones.

- Cash Value Growth: Your cash value grows over time on a tax-deferred basis, providing a potential source of funds that can be used while you’re alive.

- Tax Advantages: There are some potential tax advantages with permanent life insurance both in the accumulation of cash value and in the income tax-free distribution of the death benefit to your beneficiaries.

- Estate Planning: It can help cover estate taxes and other expenses after your death, simplifying the inheritance process for your family.

Disadvantages of Permanent Life Insurance

Just as with anything, there are some potential drawbacks:

- Higher Costs: It typically comes with higher premiums than term life insurance, particularly whole life.

- Complexity: Some policies (especially variable universal) can be more complex, making it necessary to consult with a qualified financial professional.

- Illiquidity: Accessing the cash value could potentially involve taxes and/or fees. Early withdrawals or surrendering the policy can impact your death benefit or even negate the value of the policy. It may be best to only withdraw if there is an immediate and important reason to.

Is Permanent Life Insurance Right For You?

The truth is there’s no simple yes or no. If you’re unsure, it’s wise to speak with a financial professional who can help assess your situation. They can consider factors like your financial goals, family needs, and risk tolerance to advise whether permanent life insurance aligns with your long-term plans. Remember, it is essential to understand what is permanent life insurance so you can properly plan for yourself and your beneficiaries.

Conclusion

Deciding on any kind of life insurance isn’t something to be rushed into. You have a choice to make between two primary categories of life insurance, term or permanent. With what is permanent life insurance, understanding what you’re signing up for and if it meets your needs, and your loved ones’ needs, as well as aligns with your long-term goals is absolutely critical. Talking this over with a financial professional could clear up a lot of the uncertainty.

FAQs about what is permanent life insurance

What is permanent life insurance and how does it work?

Permanent life insurance is designed to last your entire lifetime. You pay premiums (usually on a set schedule) and as long as they’re paid, your beneficiaries are guaranteed to get a death benefit when you pass. This differs from term life insurance, which only covers a specific period. Along with the death benefit, permanent policies usually have a savings element (called cash value) that grows tax-deferred.

What are the disadvantages of permanent life insurance?

The biggest downsides are cost and complexity. It tends to be more expensive than term life insurance, especially for the same death benefit. Some types can be complex with investment options and flexible features. Managing those might require professional advice to avoid negatively impacting your cash value or death benefit. You can always meet with a financial advisor or other financial expert to guide you through.

Do you get money back from permanent life insurance?

This is where the “cash value” aspect comes in. While you’re alive, a portion of your premiums goes into this cash value, and it can potentially grow (tax-deferred) depending on your policy. You might have the option to withdraw from it, borrow against it (though that usually affects your death benefit), or sometimes use it to pay your premiums in retirement. If you cancel your policy (called surrender), you might receive the accumulated cash value (minus any fees). This varies depending on your type of policy and its specifics, and keep in mind withdrawals usually affect the death benefit.

Why do people buy permanent life insurance?

There are a few common reasons. They want lifetime coverage (knowing a payout is guaranteed regardless of *when* they pass), the savings feature (as the cash value can be used while they’re still alive for various financial goals), or they’re interested in the tax benefits. Some also see it as part of their estate planning strategy to help cover expenses and provide an inheritance for their loved ones.

Can I convert term life insurance to permanent life insurance?

Yes, many term life insurance policies include a conversion option that allows you to convert your coverage to a permanent policy without having to undergo a new medical exam or answer health questions. This conversion feature is particularly valuable if your health has declined since you originally purchased your term policy, as you can typically convert at standard rates regardless of your current health status. The conversion is usually available within a specific time window, often during the first 10 to 20 years of your term policy, or up to a certain age like 65 or 70, depending on your policy’s terms. When you convert, your new permanent policy will have higher premiums than your original term policy because permanent insurance is more expensive, but you’ll gain the benefits of lifelong coverage and cash value accumulation. It’s important to review your policy documents or contact your insurance provider to understand your specific conversion options, including any deadlines and the types of permanent policies available for conversion. Many people choose to convert when they realize they need coverage beyond their term period, want to build cash value, or have developed health conditions that would make qualifying for a new policy difficult or expensive.