Thinking about how does life insurance works is important. It’s about making sure the people you care about are taken care of, even when you’re not there. This is one of those things a lot of people wonder about but might be nervous to ask about.

But we’re all friends here. This isn’t a fancy conference with confusing jargon. We’re going to talk about life insurance in a way that actually makes sense. And I promise, it’s less confusing than you think.

Table of Contents:

- How Does Life Insurance Actually Work?

- Different Types of Life Insurance

- How Are Life Insurance Premiums Determined?

- What Does a Life Insurance Payout Cover?

- Benefits of Getting Life Insurance

- Making Life Insurance Work for You

- FAQs about how does life insurance work

- Conclusion

How Does Life Insurance Actually Work?

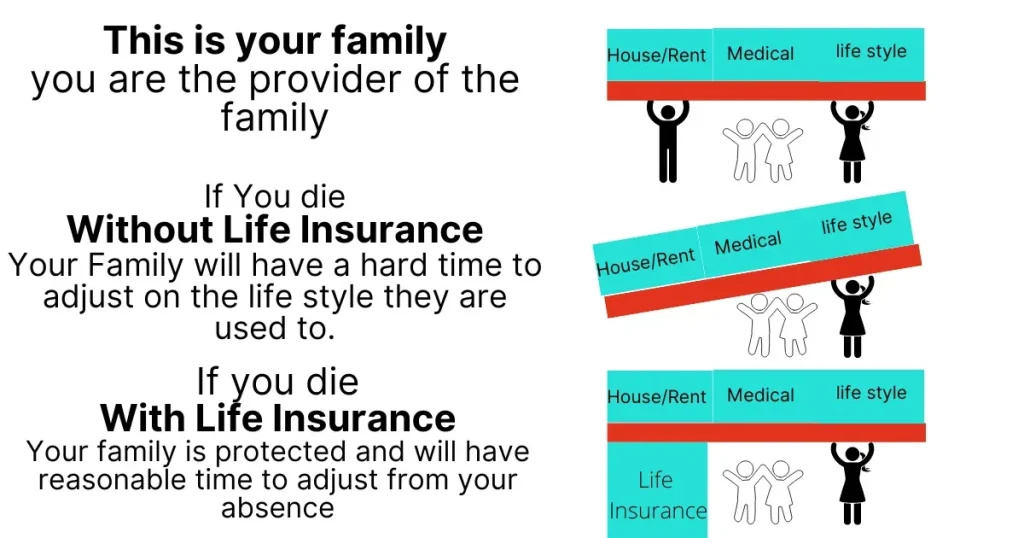

Alright, picture this: life insurance is a promise. You’re basically saying, “Hey, if something happens to me, I want to make sure my family is okay.” This “promise” you buy from an insurance company comes with a price – a regular payment called a “premium”. Think of it like a subscription for peace of mind.

Here’s the deal: you pick how much insurance coverage you think your loved ones would need if you were gone. This payout is called the “death benefit”. When you pass away, the life insurance company steps in and gives that money to the folks you’ve chosen – your beneficiaries. Pretty simple, right?

Different Types of Life Insurance

Now, like most things in life, life insurance comes in a few flavors. It can be kind of confusing to know which one is best. Let’s dive in, and I’ll break down these life insurance options.

Term Life Insurance

Term life insurance is pretty straightforward. It covers you for a set period, think 10, 20, or 30 years. Imagine it as a safety net for a specific time frame.

Say you want to ensure your kids’ college tuition is covered, even if you aren’t there. This one usually has lower monthly payments, which makes sense since it’s not a lifetime thing. Term life insurance can also help cover expenses if a parent dies unexpectedly.

Whole Life Insurance

On the flip side, whole life insurance sticks with you as long as you keep up with those premiums. Think of this type as a permanent solution for providing financial support to your loved ones.

This one can be a bit pricier. It’s a personal call if you think a lifetime of coverage with a cash value account makes sense for you. This cash value account can be beneficial for long-term financial goals.

How Are Life Insurance Premiums Determined?

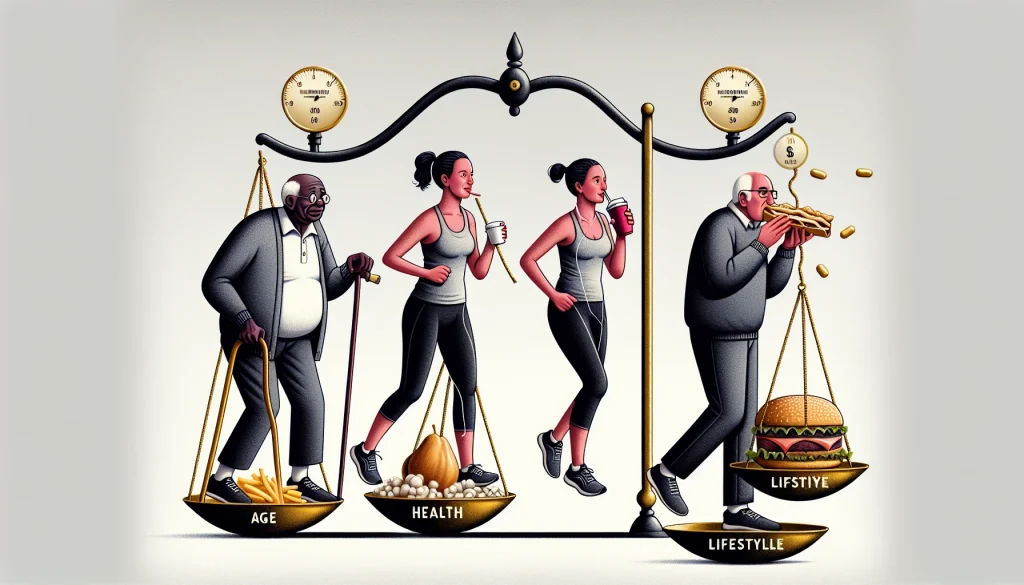

Ok, so how do they figure out how much you’re going to pay for this whole “life insurance thing”? The good news, it’s not a guessing game. Insurance companies use several factors to calculate your premiums, such as whether you need a medical exam.

Insurance companies analyze risk. This means looking at stuff like how old you are, your overall health (think medical history, weight), if you’re a smoker (the CDC says this impacts your health in a BIG way), driving history (because nobody wants to pay extra for reckless drivers.), and even what you do for a living.

What Does a Life Insurance Payout Cover?

A life insurance payout can cover many expenses and provide peace of mind that beneficiaries will be well looked after. Life insurance is meant to make sure that the people you love don’t have a financial burden on top of everything else if something happens. But how it’s used, though, really depends.

For example, did you know that small businesses can get life insurance for their owners? It’s true. They can use the death benefit to cover expenses associated with the loss, such as hiring and training a replacement.

Some Common Uses for the Payout:

- Covering funeral costs.

- Paying off debt – think mortgages, credit card bills, loans, the works.

- Replacing the income lost when you pass.

- Taking care of your children’s future needs – such as paying for their education.

- Creating a legacy or making a donation to your favorite charity.

Life insurance helps you take care of the things you want to take care of, even if the unthinkable happens.

Benefits of Getting Life Insurance

Alright, I know this stuff can seem a little overwhelming. Life insurance offers a crucial safety net, and you can even purchase life insurance riders to enhance your coverage.

According to the Insurance Information Institute, whole life, and universal life insurance policies come with a unique advantage — cash value. This feature can act like a savings account that grows over time.

What’s more, life insurance proceeds usually go to beneficiaries without being subject to income taxes. This way, your beneficiaries get the full benefit. That’s one less thing they have to worry about, right?

Making Life Insurance Work for You

Life insurance can feel complicated but it doesn’t have to be. We covered the basics of how life insurance works. And you learned about term life insurance versus whole life insurance.

Remember, figuring out if life insurance is right for you is all about looking at your situation. This article is here to point you in the right direction. Make sure to shop around for the right insurance to fit your needs.

Conclusion

Figuring out how life insurance works can feel like navigating a maze of complicated terms and policies. Life insurance is there to provide financial security. And while it might seem overwhelming, arming yourself with the right information is key to navigating it with confidence.

FAQs

How long do you have to pay life insurance before it pays out?

You usually have to pay life insurance premiums throughout your lifetime or the specified term of the policy to maintain coverage and ensure the death benefit is paid out. The payout itself occurs after the policyholder’s death.

What is the cash value of a $10,000 life insurance policy?

It’s not quite that simple. You see, cash value is a feature specifically tied to permanent life insurance policies (like whole life or universal life). In those cases, a portion of your premium payments goes toward this savings component.

How does the life insurance policy work?

We already broke it down earlier but here’s another way to look at it – it’s a two-way street. You pay premiums, and the insurance company agrees to pay a specific amount (the death benefit) when you die to those you choose. This money provides financial security to help your loved ones.

Do you really get money from life insurance?

Here’s the truth: if your life insurance policy is active when you die (and you’ve kept up with payments), your beneficiaries absolutely do receive the payout, or the “death benefit”, to help with expenses. This payout typically comes as a lump sum payment.

How do beneficiaries claim life insurance benefits?

Beneficiaries must actively file a claim with the insurance company to receive life insurance benefits, as insurance companies don’t automatically distribute payments when a policyholder passes away. To start the claim process, beneficiaries should contact the insurance company directly, either through their website or by phone, and request a claim form. They’ll need to provide essential information including the policy number, the deceased’s personal details, and a certified copy of the death certificate. Most insurance companies also require proof of identity from the beneficiary making the claim. The timeline for receiving payment typically ranges from a few days to several weeks after submitting a complete claim, though most insurers process claims within 30 to 60 days. In some cases, claims may be delayed if the death occurred within the first two years of the policy or if there are unusual circumstances requiring investigation. Once approved, beneficiaries can usually choose to receive the death benefit as a lump sum payment or in installments, depending on the policy options available.