Figuring out how much life insurance you need. Figuring out how much life insurance you need can feel like trying to predict the future. It’s a task that’s often put off, but knowing your loved ones would be financially secure even if the unexpected happens can bring huge peace of mind.

Table Of Contents:

- Why Life Insurance Matters

- Factors That Determine Your Needs

- Common Methods to Calculate Coverage

- Seek Professional Advice

- Conclusion

- FAQs About How Much Life Insurance Do I Need

Why Life Insurance Matters

Many people think life insurance is just about covering funeral costs. It can definitely help with that. However, life insurance is about a lot more than final expenses. Imagine all the financial pieces you fit together to make your life work – your income, your savings account, maybe a mortgage.

Life insurance is like a safety net for those pieces. If something were to happen to you, it helps ensure your loved ones aren’t burdened with debts or a loss of income. A life insurance policy helps your beneficiaries pay off debts, cover living expenses, and maintain their quality of life.

Factors That Determine Your Needs

There isn’t a magic one-size-fits-all number for how much life insurance you need. It varies based on your personal loans, what’s important to you, and your particular family situation. But don’t worry, we can break this down into manageable parts.

Income Replacement

Think about this: How would your family manage financially without your income? That’s where income replacement comes in. Consider your take-home pay and how many years your loved ones would need that financial support.

This helps ensure your family can maintain their current lifestyle even without your paycheck. This helps factor in things like daily living expenses, paying down credit cards, or even future costs like college. Did you know the average cost of raising a child born in 2015 is around $233,610, according to the USDA?

Debt

Do you have any outstanding debt, like a mortgage, auto loan, or credit card balance? Factor these in when determining your life insurance needs. After all, you wouldn’t want your loved ones stuck paying those off on top of everything else. Having enough insurance coverage to eliminate those debts would remove a huge potential burden.

Dependents

If you have kids, especially young ones, you’ll likely want a higher amount of coverage to ensure they’re financially supported until adulthood. Childcare costs alone can be overwhelming for single parents. It’s about securing their future and giving them the opportunities you would want them to have.

Plus, the cost of college has been consistently on the rise, putting further strain on families. It can be a smart move to use life insurance as a means to contribute toward your kids’ educational future. To give you an idea of just how much costs are increasing, the cost of tuition at public 4-year institutions increased 9.24% from 2010 to 2022.

Other Expenses

Don’t forget about those often overlooked but necessary expenses, like funeral costs. These can add up, with a median cost of $7,848 for a funeral with a viewing and burial, based on 2021 data from the National Funeral Directors Association.

Common Methods to Calculate Coverage

I know crunching numbers isn’t everyone’s idea of fun. To make it easier, there are several different approaches people often use. There are simple rule-of-thumb methods, or more in-depth calculators that factor in your specific circumstances. Here’s a peek:

| Calculation Method | How It Works |

|---|---|

| Multiple-of-Income | Take your annual income and multiply it by a certain number, like 10 or 15. |

| Years-Until-Retirement | Multiply your income by how many years you have left before retirement to get an idea of potential future income lost if something happened to you. |

| DIME (Debt, Income, Mortgage, Education) | Add up all your outstanding debts, and factor in future income needs and expenses like education. This is a more comprehensive approach to ensure all bases are covered. |

You can use one or combine methods, whatever helps you wrap your head around how much life insurance do I need for your peace of mind. Keep in mind: Many find using an online life insurance calculator helpful for visualizing their needs based on their personal situation. It can be really eye-opening to see how the numbers change based on different inputs.

Why Bother with Life Insurance?

“Life insurance is a way to ensure that your loved ones are financially protected even if you’re no longer around.”

Calculating Your Life Insurance Needs

To determine how much life insurance you need, consider the following factors:

- Final expenses: funeral costs, medical bills, and other expenses associated with your passing

- Income replacement: the amount of money your family would need to maintain their current lifestyle

- Debt: outstanding debts, such as a mortgage, car loans, and credit card debt

- Education expenses: the cost of your children’s education

- Other expenses: any other expenses that your family would need to cover in your absence

Get Started Today

Don’t put off calculating your life insurance needs any longer. Take the first step towards giving your loved ones the financial security they deserve.

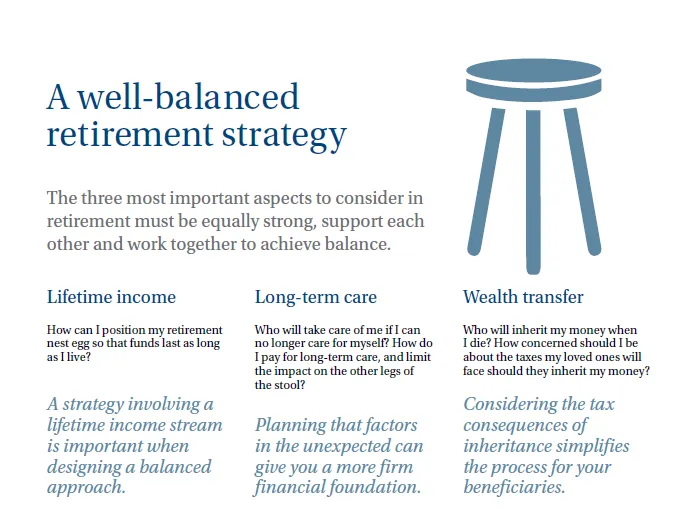

Seek Professional Advice

I’ve learned it’s helpful to chat with a financial advisor who specializes in life insurance. They can help you decide which method makes the most sense for you and explain all the policy options available. Remember, there’s term life insurance, whole life insurance, and variations on those that might be a better fit depending on your situation and goals.

Conclusion

The peace of mind that comes with knowing your family is protected? Totally worth it. Remember: Getting life insurance isn’t just about planning for the worst – it’s about being proactive, being responsible, and ensuring the ones you care about most are looked after. Knowing how much life insurance I need is the first step.

FAQs About How Much Life Insurance Do I Need

What is a good amount of life insurance to have?

While there is no “magic number” for everyone, a helpful guideline is to have coverage around 10-12 times your annual income, especially if you’re the primary earner. This ensures your family can maintain their current standard of living even if something happens to you. Additionally, you’ll want to consider factors like existing debt, childcare or education costs for children, and end-of-life expenses like funeral costs.

Is $500,000 life insurance enough?

that $500,000 in coverage might be sufficient for some individuals but might fall short for others. Consider, that $500,000 wouldn’t be enough to support your loved ones for many years if you were the main income earner. On the other hand, it could be sufficient for covering outstanding debts and final expenses if you’re single or have fewer dependents.

Think carefully about how long this amount needs to last for your family and what expenses it would be used for. This underscores the importance of taking your specific circumstances into account when figuring out an appropriate coverage amount.

How much should you be covered for life insurance?

It all depends on what financial commitments and goals you have. It’s about ensuring your loved ones have the resources they need for expenses. These expenses can include covering a mortgage, funding children’s education, replacing lost income, and handling any existing debts.

Don’t just grab a random number. Thin about those aspects unique to your family, crunch some numbers based on income replacement or other calculation methods, and get advice from a financial professional.

Is $100,000 life insurance enough?

$100,000 in coverage might seem like a lot at first, but consider that would only provide $274 per day for a year if something were to happen to you. It might sufficiently cover funeral costs and some smaller debts, but would likely fall short in replacing lost income or addressing long-term financial needs.

While any coverage is better than none, don’t assume a small amount will provide comprehensive security for your loved ones. Life insurance is meant to replace a portion of your income for your loved ones, which typically necessitates a more substantial amount of coverage.

Should I adjust my life insurance coverage over time?

Yes, it’s wise to periodically review and adjust your life insurance coverage as your life circumstances change. Major life events often signal the need to reassess your coverage amount, including getting married, having children, buying a home, starting a business, experiencing significant salary increases or decreases, or approaching retirement. As your financial obligations grow, you may need to increase your coverage through purchasing an additional policy, adding a guaranteed insurability rider, or converting your term policy to permanent coverage. Conversely, as you get older and your dependents become financially independent or your debts are paid off, you might find you need less coverage than before. Most financial experts recommend reviewing your life insurance coverage at least every three to five years, or immediately after any significant life change, to ensure your policy still aligns with your family’s financial protection needs and your current circumstances.