People often ask, “What does term life insurance mean,” and it’s a great question to explore. In simple terms, term life insurance is like renting an apartment for your financial security. You pay a premium for coverage over a specific period (the term), typically 10, 20, or 30 years. But if you’re trying to decide between term and permanent life insurance, understanding what does term life insurance mean is important.

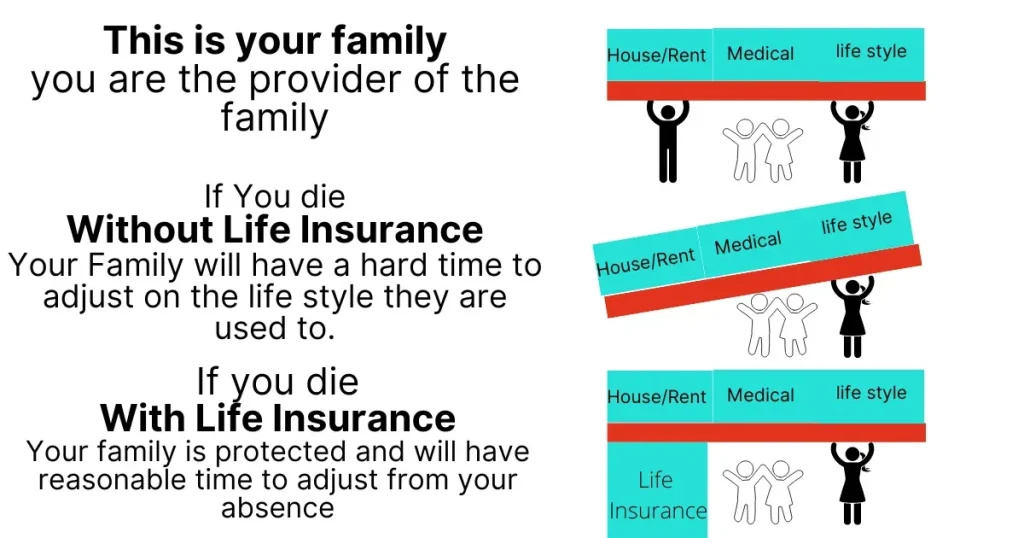

Here’s the deal: if you pass away during that term, the insurance company pays a lump sum (the death benefit) to your beneficiaries. This money helps them manage financially without your income. But if you outlive the term, the coverage ends, and you don’t get anything back.

Think of it like this: your rent is paid for that apartment, but once the lease is over, you move out. No equity, no ownership, just temporary peace of mind.

Table of Contents:

- Term Life Insurance vs Permanent Life Insurance

- Who Needs Term Life Insurance?

- Benefits of Term Life Insurance

- Potential Drawbacks

- How Much Does Term Life Insurance Cost?

- What Happens At The End of The Term?

- Understanding Life Insurance Riders

- Making The Choice: Term or Permanent Life Insurance?

- FAQs about what does term life insurance mean

- Conclusion

Term Life Insurance vs Permanent Life Insurance

Alright, so what sets term life insurance apart from its more permanent sibling? I’ll tell you.

Term Life Insurance

This one is straight to the point. It provides coverage for a specific time frame, and that’s it. It usually offers the highest death benefit for your buck, making it a popular choice for young families on a tighter budget who want to secure their financial future during those critical years.

Permanent Life Insurance

Permanent life insurance is more like buying a house: a long-term commitment with some investment potential. It stays with you throughout your life (as long as premiums are paid) and often includes a savings component (cash value). Over time, you can borrow against this cash value and even use it to pay your premiums.

While generally more expensive than term life insurance, it’s appealing to folks looking to build long-term wealth and pass on a legacy to their heirs. It comes in different types: Whole Life, Universal Life, and Variable Life – each with nuances.

Who Needs Term Life Insurance?

Many people wonder if term life insurance is right for them. It might be if you’re:

- A young family on a tight budget but wants the most coverage.

- Paying off a mortgage and want peace of mind, knowing your family wouldn’t lose their home if something happened to you.

- Starting a business and want to secure your partner’s stake if anything happens.

- Paying off any large debt. Nobody wants to leave their loved ones with those bills after they are gone.

Benefits of Term Life Insurance

There are quite a few things to like about term life insurance. It offers:

Affordability

You’ll likely pay lower premiums than with a permanent life insurance policy, getting you more bang for your buck, especially if you’re younger and in good health.

Flexibility

You can pick a term length that matches your needs, like aligning with the years until your kids finish college or your mortgage is paid off.

Plus, if you’re feeling like you want to switch things up down the road, you might have options to renew for another term, convert to permanent life insurance, or let the coverage lapse if your circumstances change.

Simplicity

Term life policies are straightforward – you pay your premiums; you’re covered. There are no complex investment components to worry about.

Peace of mind

This is a big one. Term life insurance provides a safety net for your loved ones during a set period when they may need it most.

Potential Drawbacks

Term life insurance doesn’t work for every situation. Like any financial product, it has a few drawbacks.

No Cash Value

Unlike some permanent policies, term life is strictly about a death benefit. There is no building savings or cashing out.

Premiums Increase With Renewals

Each time you renew your term insurance for another term, you’ll likely face higher premiums as you get older, which is natural as risks increase. In some cases, policies can become very expensive in your senior years, even though coverage amounts are likely less needed by then.

No Coverage After the Term

If you outlive the term, your policy expires. This can leave you with no coverage just when your health issues might make obtaining new life insurance impossible, or the monthly premium incredibly high.

However, if your policy has a conversion feature, you might have the option to switch to a permanent life insurance policy during a set window (usually early in the term) without needing another medical exam, even if your health has declined.

How Much Does Term Life Insurance Cost?

Lots of things factor into the cost of life insurance, but age and gender are two big ones. These are considered primary factors by many sources, including the Texas Department of Insurance.

And here’s something surprising: about half of Americans overestimate how much it costs. This misunderstanding, as pointed out by financial services industry researcher LIMRA, means many people may be putting off financial protection because they think it’s pricier than it is.

As an example, a healthy 30-year-old woman can get a $20,000 term life insurance policy for less than $8/month. But, by the time she’s 55, a policy with the same amount might cost around $25.50/month. It’s generally cheaper for women, simply because we tend to outlive men (sorry, guys.).

| Term Life Insurance Rates for Women | |

| Age | Monthly Premium for $20,000 |

| 30 | $8 |

| 55 | $25.50 |

For a deeper dive into cost differences, consider a $50,000 policy: it’s estimated at $14/month for a healthy 25-year-old woman but $60 for a 55-year-old. This age gap really impacts pricing, huh?

Now let’s check the cost of a $50,000 policy for men: it would cost a 25-year-old around $22.50, while a 55-year-old could expect to shell out about $86.50 each month. You can compare average monthly life insurance costs across various ages and policy types.

What Happens At The End of The Term?

At the end of a term life insurance policy’s term, the coverage stops. You can often choose to renew, though likely at a much higher rate than you were previously paying.

You can also convert to a permanent life insurance policy if that option is built into your term life policy. If your term life insurance policy doesn’t offer that, you may want to buy a permanent insurance policy. It’s a choice you’ll want to think carefully about based on your family’s needs.

Understanding Life Insurance Riders

Those insurance terms can sound complex. Take ‘riders,’ for example they’re basically optional extras you can add to a policy to expand coverage. Some common riders for term life include:

Accelerated Death Benefit Rider: This gives you access to a part of the death benefit if you’re diagnosed with a terminal illness. It’s meant to help manage end-of-life care expenses without wiping out savings meant for your beneficiaries.

Accidental Death Benefit Rider: This one provides additional coverage if you die as a result of an accident. If, sadly, your passing was due to an unexpected event (car crash, workplace mishap), this rider pays a lump sum to your loved ones on top of the base death benefit.

Guaranteed Insurability Rider: This allows you to buy more life insurance in the future, no matter your health, within a set window.

Disability Income Rider: This adds a safety net if you become disabled. It kicks in if an injury or illness stops you from working, providing you with regular income replacement while you can’t earn.

Child Rider: This lets you include children under your policy. This smaller policy on their lives helps manage potential funeral expenses if they pass, with benefits often increasing automatically as the child ages.

Remember, those are just a few options. Different riders come with different costs, and you’ll want to compare what fits best for you and your family. For instance, if you have young children, a child rider could make sense, whereas a guaranteed insurability rider might benefit someone planning to expand their family in the future.

Making The Choice: Term or Permanent Life Insurance?

There’s no one-size-fits-all solution when it comes to life insurance. Choosing between term or permanent life insurance requires careful thought and an honest look at your needs, budget, and financial goals. Term policies provide coverage for a defined period, while permanent ones offer lifelong protection, as long as the premium payments are maintained.

Think about these things:

- What are your priorities? Temporary coverage or lifelong protection?

- What are you trying to accomplish? Providing for loved ones during a specific period, creating a long-term wealth-building vehicle, or even planning for estate taxes?

- What can you comfortably afford in monthly premiums? This impacts the policy amount and type you qualify for.

One crucial piece of advice – it’s worth getting expert guidance. Talking to a qualified financial advisor can clarify the often-complex insurance world. This way, you’re choosing life insurance from a place of knowledge and peace of mind.

Conclusion

Life is unpredictable. Term life insurance plays a vital role in financial planning, helping safeguard families. But what does term life insurance mean in practical terms?

It offers a way to financially protect loved ones in those years when they need it most, at an often affordable price. But it also comes with some drawbacks. Weigh those pros and cons carefully to determine if term life life insurance is right for you.

Making choices about life insurance should come from knowledge. Take time to research. Speak to a trusted financial advisor to find what truly suits your goals and budget.

FAQs about what does term life insurance mean

What is better, term or whole life insurance?

Deciding between term or whole life insurance depends on individual needs. Term life provides temporary coverage and lower initial costs. Whole life provides lifetime protection and builds cash value but premiums are higher. Ultimately, the best option aligns with your financial situation, goals, and risk tolerance.

How does term life insurance work?

Term life provides coverage for a set term (10-30 years). You pay monthly premiums, and if you pass during that time, your beneficiaries get a payout. But if you outlive the term, coverage ends with no payout. It’s similar to renting an apartment: you pay for use for a specific time.

What happens at the end of your term life insurance?

The policy expires. But you may have options like renewing (usually at higher rates), converting to permanent life insurance if allowed, or simply letting it lapse. Carefully consider what works for your situation.

What are the disadvantages of term life insurance?

Term life insurance doesn’t build any savings and has no cash value, as some permanent policies do. Your premiums usually jump higher with each renewal, as you get older. Plus, the coverage ends completely once the term is over. This means no death benefit is paid out if you outlive your policy’s term.

How do I convert my term life insurance to permanent life insurance?

Converting your term life insurance to permanent coverage is typically straightforward if your policy includes a conversion rider or conversion option, which most do. First, review your policy documents to confirm you have this feature and check the conversion deadline – many policies allow conversion within the first 10 to 20 years of the term, or before you reach a certain age (often 65-75 years old). The major benefit of converting is that you won’t need to undergo a new medical exam or answer health questions, which means any health issues that developed since you bought your original policy won’t affect your eligibility or rates. However, your new permanent life insurance premiums will be based on your current age, not your age when you first purchased the term policy, so they will be higher than your term premiums. To initiate the conversion, contact your insurance company or agent directly to discuss your options – they can explain which types of permanent policies are available (typically whole life or universal life) and help you calculate the new premium costs. You can often choose to convert your entire death benefit or just a portion of it if the full permanent policy premium is too expensive. It’s wise to compare the cost of converting versus purchasing a brand new permanent policy elsewhere, though conversion usually offers better value if your health has declined. Don’t wait until the last minute – start the conversation with your insurer at least 6-12 months before your conversion deadline to ensure you have time to make an informed decision about this important financial choice.

Conclusion

Life is unpredictable. Term life insurance plays a vital role in financial planning, helping safeguard families. But what does term life insurance mean in practical terms?

It offers a way to financially protect loved ones in those years when they need it most, at an often affordable price. But it also comes with some drawbacks. Weigh those pros and cons carefully to determine if term life life insurance is right for you.

Making choices about life insurance should come from knowledge. Take time to research. Speak to a trusted financial advisor to find what truly suits your goals and budget.