Why retirement planning is important can’t be overstated. It’s about more than just saving money; it’s securing your future independence, maintaining your lifestyle, and being prepared for health-related expenses.

A strong retirement plan empowers you to face the uncertainty of post-work life with confidence. Discover the powerful advantages of retirement planning for a transformative post-career life.

Key Takeaways

Effective retirement planning is critical for achieving financial independence post-retirement, maintaining lifestyle standards, and covering anticipated expenses, particularly healthcare costs.

Retirement planning should encompass securing lifetime income, long-term care planning, and considering wealth transfer to ensure financial stability and the desired standard of living for oneself and heirs.

Questions to Test Yourself (Retirement Age)

How sure are you about being ready for retirement with the money plans you have now, on a scale from 1 to 10?

Are you aware of the specific annual return percentage required from your retirement investments to maintain your lifestyle after you retire?

Do you know how much longer you’re going to have to work if those don’t work out?

Do you know how much you will have to reduce your standard of living to make your money last the rest of your life?

Why Retirement Planning Is Important

Imagine a future free of money troubles, where you effortlessly handle daily expenses. That’s the power of careful retirement planning, which allows you to:

Envision your post-retirement life

Establish a plan to turn that vision into reality

Align your retirement goals with various factors like your expected retirement age, the lifestyle you wish to maintain, and the expenses you anticipate

Well-funded retirement accounts

A well-constructed retirement plan can help you achieve these goals and ensure a secure future.

Whether you’re dreaming of traveling the world, starting a new business, or simply enjoying quality time with family and friends, effective retirement planning can help make it happen. But remember, it’s not a one-time task.

As you approach your retirement age, different factors will come into play, and your plan will need adjustments. Hence, early retirement planning is not just recommended; it’s essential.

Financial Security

Financial security is a cornerstone of retirement planning. It’s about ensuring that you have a steady income source for your post-retirement life.

One of the most significant concerns for retirees is outliving their retirement savings. But with sound retirement planning and proper financial planning, you can transition from a regular paycheck to a comfortable retirement income.

A well-thought-out retirement plan can help you steer clear of financial challenges in the future. By setting aside a designated amount for retirement, you’re investing in your future independence.

Remember, your retirement funds will have to cover more than just basic living expenses. There will be other costs, such as home maintenance and healthcare, which are often underestimated.

As such, careful planning is required to ensure that your retirement savings will be sufficient to cover all your financial needs.

Maintaining Lifestyle Standards

Your retirement years should be a period to reap the benefits of your hard work. But to maintain your current lifestyle post-retirement, you need an efficient retirement savings plan.

Considering the average life expectancy, it’s not just about surviving; it’s about thriving and enjoying the lifestyle you’ve grown accustomed to, even after you’ve stopped working.

Effective retirement planning includes:

Anticipating future expenses

Considering the rising cost of living due to inflation

Setting a retirement plan to ensure enough income to support your desired standard of living without being employed

Without proper planning, your ability to sustain the preferred lifestyle may be compromised. So, don’t just save for retirement; plan for it.

Health and Medical Expenses

Health is a treasure, but as we age, it often requires more investment. And while we all hope for a healthy retirement, it’s essential to plan for potential medical costs.

The truth is, that healthcare costs can skyrocket during retirement. Ignoring these possible expenses can lead to financial stress and unexpected hardships. That’s why it’s crucial to include healthcare cost inflation and potential long-term care needs in your retirement planning.

By doing so, you can ensure that your retirement savings will be sufficient to cover both your living and medical expenses, allowing you to enjoy your golden years with peace of mind.

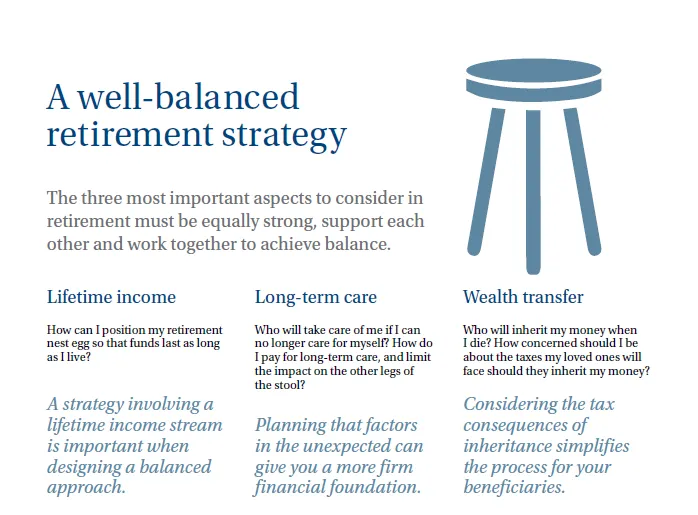

Key Components of Retirement Planning

Retirement planning is not a one-size-fits-all process. It’s a complex task that involves several key components, each playing a critical role in securing a financially stable retirement.

While the specific elements might vary depending on individual circumstances, three core components make up the backbone of any solid retirement plan: securing lifetime income, planning for long-term care, and managing wealth transfer.

To determine how much to save for retirement, you can follow these steps:

Estimate the required retirement funds by factoring in expected Expenses.

Work backward to identify the necessary cash flow & savings.

Decide on a monthly investment amount.

Compare the monthly investment amount with the estimated cost of retirement to identify any gaps & address them.

By following these steps, you can ensure that you are saving enough for a comfortable retirement.

Remember, the earlier you start this planning, the longer you have to invest and grow your savings.

Life Time Income

When we talk about life after retirement, one of the first things that come to mind is income. How will you maintain a steady flow of income or be able to cover your expenses after your job stops?

The key is to create a plan for the funds before spending, ensuring your retirement savings are used wisely and efficiently.

Long Term Care

As we age, healthcare needs often increase. Long-term care, such as home nursing or assisted living, can become a significant part of life.

However, these expenses can be daunting if not planned for. That’s where long-term care planning comes into play in retirement planning.

It involves considering potential healthcare needs and exploring insurance options to cover these costs.

Often, we focus on the financial aspects of retirement planning and forget to ask one crucial question: Who will take care of me if I can no longer take care of myself?

It’s an uncomfortable question, but one that needs addressing. Long-term care planning is about finding answers to such questions and ensuring you are prepared for all possible scenarios.

Wealth Transfer

When we think about retirement planning, we often focus on securing our future. But what about the future of our loved ones? This is where wealth transfer planning comes in.

It’s about ensuring financial security for your loved ones even after you’re gone, through mechanisms like life insurance and estate planning.

By incorporating wealth transfer into your retirement plan, you can ensure that your hard-earned wealth is passed on to your loved ones, providing them with financial stability and peace of mind.

The Role of Employer-Sponsored Plans

Retirement planning isn’t something you have to do alone. Many employers offer retirement and pension plans that can play a crucial role in your retirement planning.

These employer-sponsored plans offer tax advantages under the Income Tax Act, encourage employees to save for retirement, allow for tax-deductible employer contributions, and enable your retirement assets to accumulate tax-free.

But what happens if you change jobs? The good news is that the retirement assets accumulated in employer-sponsored plans can be transported to a new employer’s plan.

This ensures continuity in your retirement savings, regardless of job changes. By taking advantage of these plans, you can enhance your retirement savings and secure your financial future.

Supplementing with alternative investments

While employer-sponsored plans form a significant part of retirement planning, they are not the end-all.

That said, there are more options to think about. For those who like to start new things, launching a business could be a good investment choice.

Looking into private equity if you have accreditation could be a good move. It’s important to know your choices and pick ones that match your retirement goals.

knowing who you are and how you can service the world could open doors nobody envisions, but do not stop chasing your own personal legend in finding your purpose.

Strategies for Successful Retirement Planning

A successful retirement plan is not built overnight. It involves careful planning, strategic investment, and regular adjustments. One of the most effective strategies for successful retirement planning is starting early.

The sooner you start planning, the more time your money has to grow. Creating a proper foundation is important. Go slow to go fast, but do not rush your future.

Regularly Review and Adjust

Retirement planning is not a one-and-done deal. It’s a dynamic process that requires regular reviews and adjustments. The age at which you start receiving retirement benefits sets the base for the monthly benefit amount for the rest of your life.

Another critical strategy is to regularly review and update your retirement plans. Life is full of changes, and your retirement plan needs to evolve with these changes.

Regular assessments of your long-term financial goals can help you understand how your current savings break down into monthly expenditures. This is particularly crucial if you face unexpected situations like forced early retirement.

Common Retirement Planning Mistakes to Avoid

The road to a secure retirement is paved with decisions. And while some of these decisions can lead you to financial security, others can lead you astray.

Understanding common retirement planning mistakes can help you avoid potential pitfalls and stay on the path to a secure and comfortable retirement.

Neglecting Inflation

Inflation is a silent wealth eroder. It slowly but surely diminishes the value of your money over time. Neglecting inflation in your retirement planning can lead to insufficient retirement savings, as the purchasing power of your money decreases over time.

However, by including the expected rate of inflation in your retirement calculations, you can better ensure that your savings will be adequate to meet the cost of living when you retire.

Inflation doesn’t just affect the cost of goods and services; it also impacts your retirement savings. To maintain your retirement income, it’s important to periodically check income sources such as interest, dividends, rental income, and taxable income.

This ensures they keep pace with inflation, allowing your retirement savings to maintain their purchasing power in the long run.

Failing to Plan for Healthcare Costs

Healthcare costs are a significant expense in retirement, and failing to plan for them can lead to financial stress and unexpected hardships.

Many individuals incorrectly assume that their employer-provided health benefits will continue after retirement, leading to significant uncovered expenses due to the cessation of these benefits.

Including the anticipated healthcare expenses in your retirement strategy helps you steer clear of unexpected financial challenges.

Adequate healthcare cost planning is essential in retirement planning to avoid unforeseen financial difficulties during the retirement years. After all, a healthy retirement is a happy retirement. having a good fitness & eating routine will help lower your risk factors.

Summary

Retirement planning is not just about numbers and financial goals; it’s about envisioning your future and making it happen. It’s about ensuring financial independence, maintaining lifestyle standards, and preparing for health and medical expenses.

By grasping the essential elements of retirement planning and leveraging the benefits of employer-sponsored plans, you can establish a solid foundation for a retirement that is both secure and fulfilling.

Remember, the journey to retirement is a marathon, not a sprint. It requires careful planning, strategic decision-making, and regular reviews and adjustments.

By avoiding common retirement planning mistakes and maintaining a proactive approach, you can cross the finish line in style. So, start planning today, and make your golden years truly golden.

Frequently Asked Questions

How to retire?

To embark on retirement, it’s essential to have a clear understanding of your monthly financial needs and to establish strategies now that will ensure they are met in the future.

What are three reasons it’s important to save for retirement?

It’s important to save for retirement for three key reasons: to benefit from compound interest, protect against market risk, and practice financial discipline. Start saving now to secure your future.

Why is it important to begin planning for retirement early?

Getting an early start on retirement planning provides more financial security, peace of mind, and enough funding to cover expenses and dreams. It’s crucial to start today for a higher quality of life in your golden years.

What is the importance and process of retirement planning?

Retirement planning is essential for securing your future independence and achieving your goals. It involves setting retirement goals, estimating the necessary funds, and making strategic investments to grow your savings.

How can employer-sponsored plans contribute to retirement planning?

Employer-sponsored retirement plans help employees save effectively for their retirement by allowing tax-deductible employer contributions and tax-free asset accumulation. These plans are a valuable tool for retirement planning.