Wondering what is supplemental life insurance and if you need it? At its core, what is supplemental life insurance refers to additional coverage you can opt for on top of a basic life insurance policy.

It’s designed to fill in coverage gaps and adapt to your unique financial circumstances, often offered by employers, but also available privately.

This article will look at why you might want supplemental life insurance, what kinds you can get, its good points, and how to figure out if it’s a good fit for you.

Key Takeaways

Supplemental life insurance enhances basic employer-provided policies by providing additional layers of financial protection, often with the convenience of bypassing medical exams.

Multiple supplemental life insurance choices are on offer, such as term life, whole life, and accidental death & dismemberment (AD&D) policies.

Each comes with its own set of perks and degrees of coverage. Certain plans also have the advantage of extending coverage to spouses and dependent children.

It’s crucial for individuals to take stock of significant life milestones, financial responsibilities, and any shortfalls in current insurance coverage, while also engaging in periodic policy evaluations to ensure that their insurance protection evolves in step with their changing life situations.

Offer Supplemental Life Insurance

Supplemental life insurance is like the extra layer of frosting on a cake – it adds sweetness and depth. Just as a basic life insurance policy provides a safety net, supplemental life insurance adds an extra layer of protection, filling in any coverage gaps and offering peace of mind.

This additional coverage is typically offered by employers as part of their benefits package, complementing the employer’s group life insurance offering.

This isn’t a specific type of policy but rather an extension of existing coverage. The purpose of supplemental life insurance is to offer extra protection and ensure that your life insurance plans align with your individual needs.

Supplemental life insurance is available in three primary forms: term life insurance for temporary coverage, whole life insurance for permanent coverage, and coverage based on the specific amount of insurance needed.

Why Supplemental Life Insurance Exists

An average employer plan typically offers life insurance coverage equal to one to two times the employee’s annual salary. This benefit helps provide financial protection for employees and their families in case of unexpected events.

While this may sound good enough, it can fall short for those with larger families or greater financial obligations.

Supplemental life insurance can be a lifeline in these situations. One of its major advantages is that it’s often available without a medical exam, making it an attractive option for employees with pre-existing health conditions that could lead to higher premiums or denial of coverage.

By offering supplemental life insurance, employers enhance their benefits package, providing employees with opportunities to secure robust coverage that aligns with their individual needs.

How Supplemental Life Insurance Works

Now, you might be wondering how to get supplemental life insurance. The process starts by selecting the desired amount of coverage above the basic policy provided by an employer.

The underwriting process is simpler, known as a ‘guaranteed issue’, where there might be no need for medical examinations or health questionnaires.

Once the policy is in place, premiums for supplemental life insurance are typically deducted from the employee’s paycheck if coverage is obtained through an employer.

Maintaining the policy requires the policyholder to pay premiums regularly and keep the policy updated with any life changes.

It’s important to note that a change in employment status can affect the status of supplemental life insurance coverage, potentially requiring conversion to a private policy to maintain protection.

Types of Supplemental Life Insurance Policies

Just as you’d choose the best ingredients for a recipe, selecting the right type of supplemental life insurance policy is crucial. Employers may offer a variety of options, including:

Group term life insurance

Group whole life insurance

Spouse or child life insurance

Accidental death and dismemberment insurance

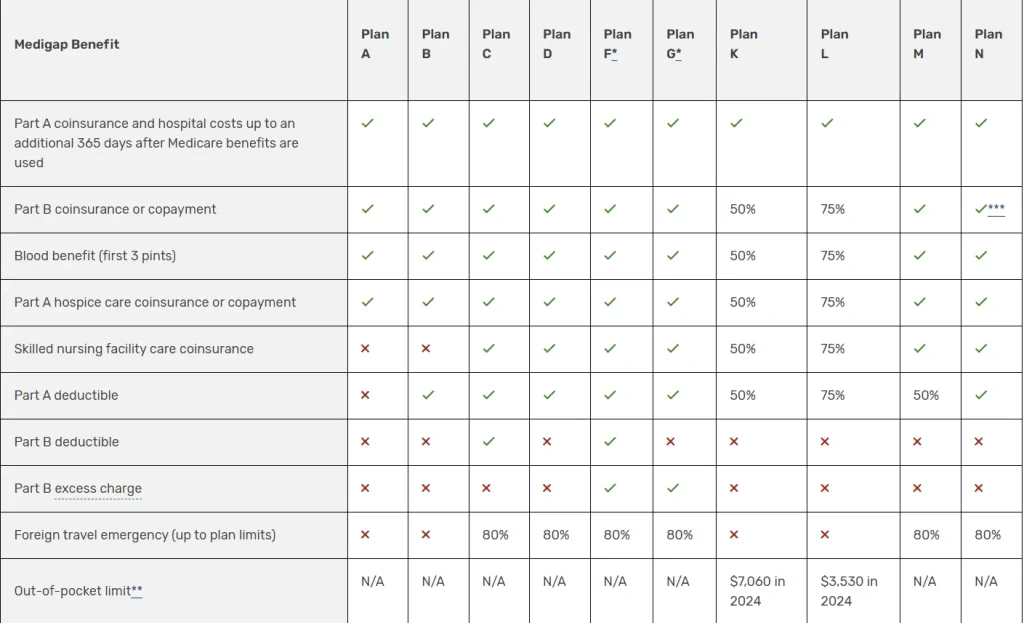

Medicare Supplement Insurance (Medigap) policies complement original Medicare plans by covering out-of-pocket costs like deductibles, copayments, and coinsurance, effectively bridging the “Medicare gap”.

Medicare Policies

Medicare policies are a key component of government-provided health insurance for seniors and certain younger people with disabilities.

Medicare Part A covers hospital stays and some forms of home healthcare, while Part B deals with outpatient care and preventive services.

While these provide a foundation, they usually don’t offer comprehensive life insurance coverage. This is where Medigap, also known as Medicare Supplement Insurance, comes in, filling the gap. Plans offered are A, B, C, D, F, G, K, L, M, & N.

Medigap plans, which are available through private insurers, are designed to assist with healthcare expenses not covered by original Medicare, such as copayments, coinsurance, and deductibles.

Group Term Life Insurance

Group term life insurance is essentially a short-term safety net provided by an employer. It pays out only if the insured person passes away within the time frame the policy covers.

While it offers a basic level of financial protection, for many, it may not be sufficient to cover all financial needs and responsibilities.

That’s where supplemental group term life insurance comes in. With this, you have the option to purchase additional coverage for a more substantial benefit.

This means that if you have a larger family or greater financial obligations, you can ensure they are adequately covered in the event of your untimely demise.

Group Whole Life Insurance

Group whole life insurance, unlike term policies, provides lifelong coverage without an expiration date. It’s a permanent life insurance option available through employers, ensuring long-term financial security.

It’s crucial to understand that to maintain coverage under a group whole life insurance policy, you must keep up with the premium payments.

This ensures that as long as the premiums are paid, your coverage will continue uninterrupted, offering you and your family ongoing security.

Spouse or Child Life Insurance

Spouse or child life insurance policies provide crucial financial protection for your family. These policies offer additional coverage, ensuring that in the event of a tragedy, your loved ones receive a death benefit to help with financial needs.

Supplemental child life insurance, also known as juvenile life insurance, is designed to provide a death benefit in the loss of an insured child.

Similarly, spouse life insurance provides supplemental coverage to include a spouse, offering a death benefit to the primary policyholder in case of the spouse’s death.

Accidental Death and Dismemberment Insurance

Accidental death and dismemberment insurance, or AD&D, is a form of coverage that pays out in the event of accidental death or specific injuries.

Unlike standard life insurance, AD&D focuses on accidents, offering financial support for unexpected, severe circumstances.

Evaluating Supplemental Life Insurance Options

Choosing the right insurance policy can feel like navigating a maze, especially with the multitude of options available.

Therefore, it’s crucial to evaluate all your supplemental life insurance options carefully. Consider the terms of the plan, including its portability, to ensure it aligns with your long-term coverage needs.

While buying supplemental life insurance can be beneficial as an addition to individual coverage, it’s important to be aware of potential limitations.

Group Life Insurance Employer-Sponsored vs. Private Policies

When evaluating supplemental life insurance options, it’s important to understand the differences between employer-sponsored plans and private policies.

Group life insurance plans are often less portable, meaning they may not transfer with you if you change jobs, and they may offer less choice in terms of coverage options.

On the other hand, private policies are not tied to your job and can be highly customized to fit your personal insurance needs.

While employer plans can be cost-effective due to group rates, private policies offer the flexibility to select from a broader range of coverage options, ensuring your insurance adapts to your life’s changes.

How much life insurance? (Buy supplemental life insurance)

Cost is a significant factor when considering supplemental life insurance. Generally, term life insurance, which is most commonly offered as supplemental insurance, is more affordable than permanent options like whole or universal life.

In contrast, private supplemental life insurance policies offer increased coverage amounts and benefits, without being tied to employment or specific stipulations such as AD&D.

However, the cost of supplemental life insurance provided by employers is based on the group life insurance policy rate, influenced by factors such as:

group demographics

life expectancy

historical claims

the design of the policy

life insurance companies

Determining Your Supplemental Life Insurance Needs

Understanding your supplemental life insurance needs is like solving a puzzle. You need to consider various factors, including dependents, current financial obligations, and potential future debts.

For instance, if you have a spouse and children, you’d want to ensure they are financially secure in the event of your death. Or, if you have a mortgage or significant debt, you’d want enough coverage to pay off your debts and not burden your loved ones.

A commonly used method for estimating coverage is to multiply your annual salary by 10x. However, for a more accurate estimate, you might want to tally up your financial obligations and subtract your spouse’s income and other assets.

The goal behind this is to determine a factor based on what would happen if you could no longer be around to support your family. How long would they still need you to be a support system? The term usually is based of a 25-30x factor of human life value.

Assessing Your Financial Situation

Assessing your financial situation is a crucial step in determining your supplemental life insurance needs.

By reviewing current debts, future expenses, and the needs of your dependents, you can estimate if your existing coverage is sufficient.

For instance, if you have a mortgage, car loans, or credit card liabilities, these debts can add up to a significant amount. On top of that, future expenses, such as your child’s education or retirement, can put further strain on your finances.

So, when evaluating your financial situation, consider all these factors to help you determine if you need supplemental life insurance and how much coverage you should get.

When to Consider Supplemental Life Insurance

Timing is everything, and that’s true when considering supplemental life insurance, too. Significant life events, such as:

marriage

divorce

childbirth

buying a home

These pivotal moments in life often trigger the need to review your life insurance needs, particularly when you’re exploring options from various insurance providers.

Evaluating Existing Coverage

Regular evaluation and review of your supplemental life insurance policies are essential to ensure that coverage remains adequate and aligned with your changing circumstances.

For instance, if you’ve recently paid off a significant debt or your children have become financially independent, you might find that you no longer need as much coverage as before.

Conversely, if you’ve taken on new financial responsibilities or your family has grown, you might find that your existing coverage is insufficient.

In this case, supplemental life insurance can help bridge the gap, ensuring that you and your loved ones are adequately protected no matter what the future holds.

Summary

As we conclude our exploration of supplemental life insurance, we’ve gathered valuable insights into its essence, the variety it offers, and the methodologies for identifying your coverage needs.

Does this mean everyone needs a supplemental life insurance policy? No, if possible a simpler option would be to reevaluate your original health policy and improve/update it over time, but if no option exists that allows that, then a supplemental life insurance policy would be a beneficial option to explore.

The key point is this: extra life insurance helps make sure you and your family are safe from life’s surprises. check with each life insurance company.

So, take your time to look at your needs, weigh your choices, and pick what fits you best. In the end, knowing your family is protected is worth a lot. fill out a health questionnaire, speak to an insurance agent, know your employee benefit, and know your group life policy if it exists.

Frequently Asked Questions

What is supplemental life insurance used for?

Supplemental life insurance is used to provide supplemental coverage for final expenses and other unforeseen costs not covered by primary life insurance policies, such as accidental death coverage or living benefits like cash value. It offers a low benefit amount, typically between $5,000 and $10,000, and can extend coverage to family members.

Is it worth getting supplemental coverage?

It’s worth considering supplemental life insurance if your current coverage is insufficient, or if you have dependents and need extra coverage. Evaluate the cost and benefits to align it with your financial goals and needs, especially if your employer offers it at a low cost.

How does a supplemental insurance work?

Supplemental insurance provides extra cash benefits for covered medical conditions, offering additional coverage beyond your primary health plan. It can cover specific illnesses, accidents, injuries, and life insurance.

What is supplemental life insurance for spouse?

Supplemental life insurance for a spouse can provide extended coverage for your spouse in the event of their passing or offer additional benefits like cash value and accident coverage. It can be purchased as an add-on to your existing life insurance policy, such as term or whole life insurance.

What is supplemental employee life insurance?

Supplemental employee life insurance increases the existing coverage and can provide a greater death benefit, coverage for accidents, and may include options to cover additional family members. It is often offered by employers, allowing employees to fill in gaps in basic group life insurance.

Can I choose any life insurance company for supplemental life insurance?

Absolutely, you have the freedom to select from a variety of life insurance companies for your supplemental life insurance.

It’s important to compare different insurers to find the one that offers the best terms, rates, and benefits that align with your needs.

Look for companies with strong financial stability, positive customer reviews, and a track record of reliable payouts. Making an informed decision based on the coverage you need and what they offer will determine