Managing personal finances can be complicated, but advanced algorithms in AI budget tools are changing the game and helping to improve your net worth.

This article introduces you to the top AI budget tools for personal finance, focusing on how these advanced platforms can reshape the way you manage money in building wealth.

Prepare for a guide that slices through the clutter, providing straightforward, actionable insights on each tool and how it can help you navigate your financial data.

Key Takeaways

AI personal finance tools are revolutionizing money management by providing tailored advice, automating routine tasks, and helping users make informed financial decisions by collecting your financial data.

The top AI tools, such as Upside, SoFi, YNAB, Quicken, and Experian, offer unique features to cater to various financial needs, from investing, to cash-back incentives, and daily budget tracking.

AI budget tools not only simplify financial management but also enhance financial literacy, save money skills, and decision-making confidence through personalized recommendations.

Embracing AI Tools: Discover 5 AI Budget Tools for Personal Finance

A personal finance coach who understands your spending habits and provides proactive strategies for financial improvement is no longer a dream, but a reality with AI-powered tools.

AI could revolutionize personal finance management through automated budget tracking, expense categorization, and personalized financial aid.

With a personal finance assistant, you can take control of your finances and make informed decisions for a brighter financial future.

The result? Improved money management, increased savings, and a significant step towards achieving your financial goals. AI budgeting tools are changing the financial landscape, making it easier than ever to:

Manage your finances effectively

Categorizing Expenses

Set and stick to a budget

Save more money

Achieve financial success

The Power of AI in Financial Management

Leveraging AI tools could swing the balance in your favor. By utilizing technologies like machine learning, natural language processing, and predictive analytics, AI provides:

personal finance assistant with real-time insights

Automation of tasks with less manual work

data analysis

Handling the simple chore of tracking expenses and categorizing them through AI-powered tools.

Better yearly tracking for tax season.

timely reminders for monthly bills.

This automation not only streamlines financial oversight but also frees up your time for more strategic financial planning and decision-making.

Plus, the behavioral insights revealed by AI can identify spending patterns that might be interfering with your financial goals.

Based on your unique financial landscape, these tailored recommendations can give you a comprehensive guide toward more effective budgeting and financial success.

Top 5 AI Budget Tools for Personal Finance Success

It’s clear that AI budget tools are a game-changer in personal finance management, offering powerful, concise solutions

We’ve rounded up the top 5 AI budget tools that can help you on your journey to financial success:

Each of these tools offers unique features and benefits, catering to a variety of financial needs. Whether you’re a business owner, a freelancer, or someone looking to gain better control over your personal finances, there’s something for everyone. Let’s take a closer look at each of these tools.

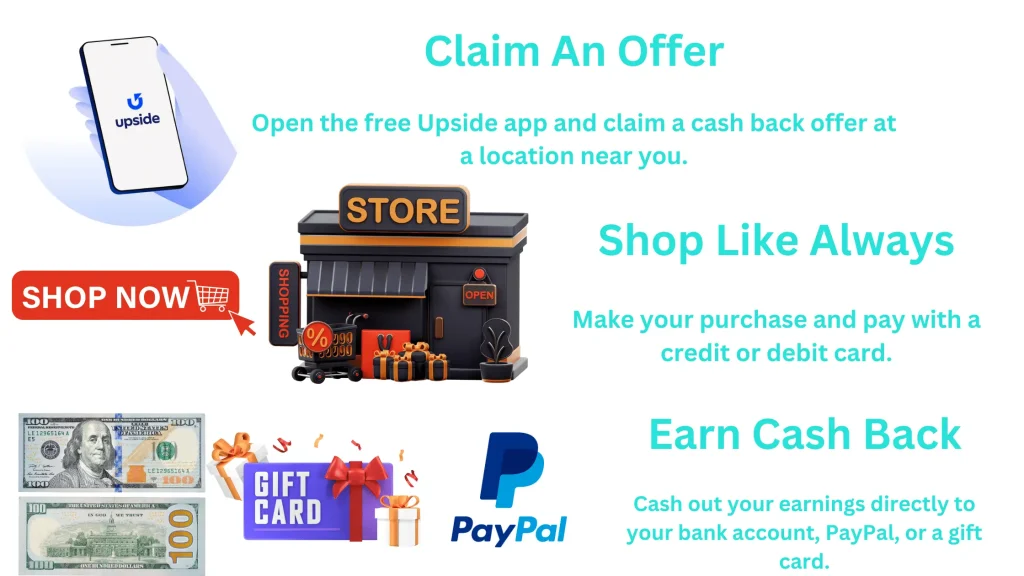

Upside

Starting off our list is Upside, a cutting-edge tool that aims to boost efficiency by giving you cash back for various amount of routine shopping activities known as Upside.

Upside offers cash-back benefits when shopping for gas, meals, or groceries. These benefits help introduce the ability to spend on a regular debit card and give you cash-back incentives for buying from the network of locations in their program.

They offer easy payout structures to your bank account, gift cards, or PayPal.

The only issue I find with the app is the % you can earn can change a lot and at times not be as effective in earning cash back for your routine locations.

SoFi

SoFi distinguishes itself as a comprehensive financial platform, offering key advantages

SoFi offers:

A budgeting tool

Investment options

Loan Refinancing

Career Coaching

Free bank account features unlike traditional banks

Investment accounts

SoFi stands out as a comprehensive service provider, catering to an array of financial needs.

Whether you aim to improve spending management, save for a major purchase, or invest for the future, SoFi provides the solution. With its user-friendly interface and robust features, SoFi makes managing your money a breeze.

Pricing: Pricing: No cost when you sign up for an account and make a deposit. Enjoy a plethora of advantages to streamline your life.

The platform leverages AI to help you track your spending patterns, offers personalized insights for saving more effectively, and even suggests investment strategies tailored to your financial goals and risk tolerance.

SoFi’s AI-driven financial advice ensures that you’re making the most of your money with smart, data-informed decisions.

YNAB

YNAB benefits include:

Real-time tracking of expenses against your budget categories, helping you stay on top of your spending.

Features that empower you to establish financial objectives and track your advancement towards these goals.

“Age of Money” metric to help you understand the health of your finances by tracking how long your money has been in your account before being spent.

Educational resources that teach effective budgeting strategies and financial management.

A supportive community and customer service to assist with any questions or challenges that arise.

Pricing: $8.25/ month Annual plan or $14.99/monthly plan.

By using YNAB, individuals can gain control over their finances, break the paycheck-to-paycheck cycle, and build a path towards long-term financial stability.

Quicken

Quicken is a time-tested financial management tool that stands out for its comprehensive features and user-friendly design. Here are some key benefits of using Quicken:

A robust platform that offers a complete overview of personal finances, including bank accounts, investments, credit card statements, and loans, all in one place.

Advanced budgeting tools that help you create detailed, customizable budgets to track and manage your spending.

Investment tracking features that enable you to monitor your portfolio, track market value changes, and assess investment performance.

Bill management capabilities that allow you to pay and track your bills, ensuring you never miss a payment.

A retirement planning feature that helps you plan for the future by evaluating your current savings and projecting your financial needs in retirement.

Tax planning tools that assist in organizing tax-related expenses, which can simplify the process of filing taxes.

Secure data protection with robust encryption, ensuring your financial information remains private and safe.

Pricing: $3.99- $10.99/month based on package level

Quicken’s comprehensive suite of tools is designed to simplify financial management, making it easier for users to stay on top of their finances and make informed decisions for their financial future.

Experian

If you’re looking for a smart budgeting tool that can help you navigate your financial journey, look no further than Experian.

Experian is not just about credit scores; it offers a suite of financial tools that can help you take control of your finances. From credit monitoring to personalized budgeting, Experian provides an array of features designed to help you manage your money more effectively.

With Experian, you can track your credit score changes, monitor for potential fraud, and access personalized advice for improving your financial health. It’s a comprehensive platform for anyone looking to enhance their financial literacy and build a stronger financial future.

Pricing: 0/month for basic $24.99/month for Premium features.

Whether you’re a freelancer balancing multiple income streams or a family planning for future expenses, Experian can be your financial ally, guiding you towards better credit and greater financial stability.

Boosting Financial Literacy with AI-Powered Tools

Even though AI budgeting tools can be overwhelming, AI-powered tools exist to enhance your financial literacy and improve your financial game.

These budgeting tools offer user-friendly interfaces that cater to users of all levels, eliminating the need for advanced financial knowledge while handling financial transactions.

Plus, they offer the opportunity to learn effective financial management practices.

Learning from AI: Enhancing Financial Skills

Learning from artificial intelligence can greatly improve your financial skills. For instance, AI supports cost-effective shopping by organizing lists by categories and suggesting household item maintenance, leading to more efficient spending and potential savings.

This aids in robust planning, cutting-edge planning for more ways to save more money

Building Confidence in Financial Decision-Making

Being confident in making financial decisions is essential for achieving your financial objectives. AI tools improve this confidence by enhancing debt repayment strategies, savings, net worth, cash flow, credit score optimization, and providing personalized financial advice to align with your unique situation.

This means with ai capabilities, every financial move you make is backed by data-driven insights, leading to more effective financial decisions and greater financial success.

Trusting AI with Your Finances

Initially, entrusting your finances to AI might seem daunting. However, by learning from your financial behaviors over time, AI budget tools offer increasingly personalized and reliable financial data.

This allows the tools to not only adjust more effectively to changing financial circumstances but also to provide comprehensive support.

Plus, AI tools have been shown to save time and reduce errors compared to conventional financial planning approaches.

Summary

In conclusion, AI is revolutionizing personal finance, spending, and retirement planning by automating tasks like expense tracking, providing data-driven insights, and offering personalized financial advice.

A selection of five distinguished AI budgeting instruments, including Upside, SoFi, YNAB, Quicken, and Experian, are equipped with distinctive capabilities to serve an assortment of financial needs.

Embracing AI in personal finance not only simplifies your life, but also enhances financial literacy, save money, builds confidence in financial decision-making, and aids in achieving financial goals.

So, why wait? Start your journey towards financial success by harnessing the power of AI today, but understand that it is a tool to support you not do everything for you. With any doubt seek expert advice to have a comprehensive guide created for your journey.

Frequently Asked Questions

What is an AI budget tool?

AI budget tools like Upside and SoFi utilize advanced technologies such as machine learning and predictive analytics to provide real-time financial insights and automate tasks such as budget tracking and expense categorization.

These tools are tailored to individual spending habits and offer personalized advice for more effective money management.

How does AI transform personal finance?

AI transforms personal finance by streamlining financial processes, offering personalized insights, and automating tasks like expense tracking and investment analysis.

This leads to improved financial decision-making and helps users achieve their financial goals more efficiently.

What constitutes the fundamentals of personal finance?

The fundamentals of personal finance revolve around five core principles: effective budgeting, disciplined saving, strategic investing, prudent debt management, and comprehensive credit understanding. Mastery of these principles lays the groundwork for solid financial health.

What are the leading AI budget tools?

The leading AI budget tools include Upside, SoFi, YNAB, Quicken, and Experian. Each tool brings unique features to the table, such as cash-back rewards, investment guidance, and detailed financial oversight, to cater to diverse financial needs and preferences.

In what ways do AI budget tools improve financial education?

AI budget tools improve financial education by demystifying complex financial concepts through intuitive interfaces and tailored guidance.

They support users in developing better financial habits, such as optimizing debt repayment strategies and enhancing credit score management, through interactive learning and data-driven insights.