Retiring comfortably is a goal that’s deeply personal to many of us. As you look to the future, you want to know that you can afford to keep living life to the fullest, without money stress holding you back from experiencing all the good things. Retirement planning can be a whirlwind, but annuities insurance will likely pop up on your radar. As retirement beckons, a predictable income stream becomes a top priority for many.

annuity and however, understanding how annuity insurance works can be confusing. This detailed look into annuities will help you understand how it can fit into your financial plan. It also discusses annuity contracts and retirement plans, and whether annuities provide the right benefits for your situation.

Table Of Contents:

- What are Annuities?

- Types of Annuities

- Classifying Annuities: Fixed, Variable, and Indexed

- Annuities Insurance: Factors to Consider

- The Role of the National Association of Insurance Commissioners (NAIC)

- Conclusion

What are Annuities?

An annuity is a contract between you and an insurance company where you make either a lump-sum payment or a series of payments. In exchange, they promise to pay you back a regular income stream. These payouts can start right away, or at some point in the future that you set.

Annuities can help give you a predictable income during retirement. They essentially turn a portion of your savings into a guaranteed lifetime income. Annuities offer various benefits and customization options that can fit a wide range of needs.

Types of Annuities

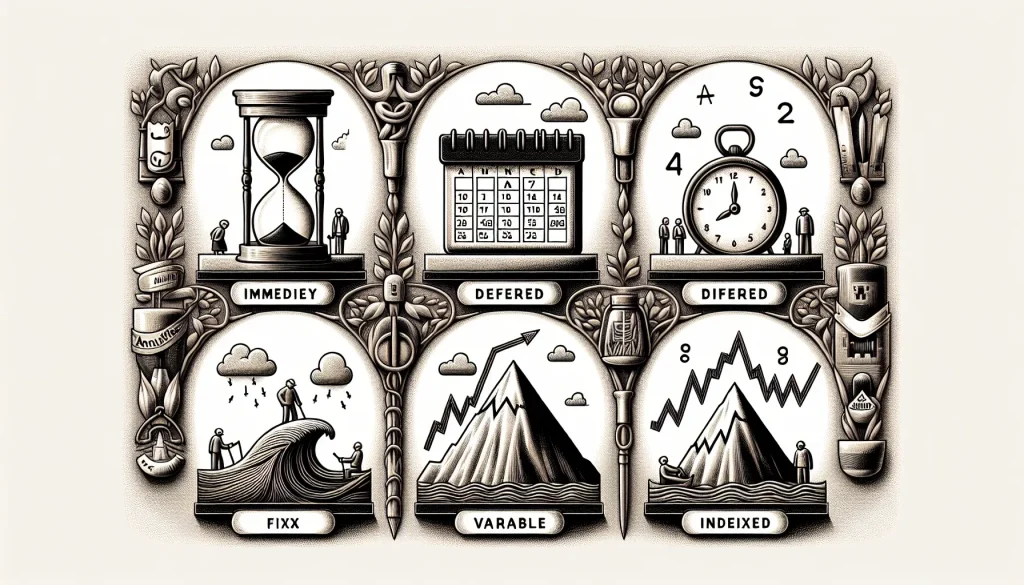

There’s no “one size fits all” solution when it comes to annuity insurance. You’ll find different types catering to different situations. Broadly, annuities fall under two primary categories: immediate and deferred annuities.

Immediate Annuities

With an immediate annuity, you start receiving income payments soon after you purchase the contract. These are best for those looking to receive regular income immediately, maybe after a lump-sum inheritance. You hand over a lump sum payment to the insurance company, and in return, they provide you with a guaranteed stream of income.

An immediate annuity can last for the rest of your life or a predetermined period. These annuities provide guaranteed income for individuals entering retirement. This is especially helpful for individuals who want to ensure their retirement savings will last.

Deferred Annuities

Deferred annuities work a little differently. They let your money grow tax-deferred over a set period of time before you begin receiving income. These make sense for those who are still saving for retirement and allow your investments to grow tax-deferred until you start taking withdrawals during retirement.

A deferred annuity is about accumulating funds, letting them grow, and then converting them into a stream of income for later. There are different types of deferred annuities including fixed period, deferred fixed annuities, and deferred income annuities.

Classifying Annuities: Fixed, Variable, and Indexed

Beyond the timing of payouts, annuities are also classified based on how their returns are structured: fixed, variable, and indexed. This helps understand the nature of potential returns you can expect from these annuities. Each of these annuity structures, fixed annuities, indexed annuities, and variable annuities, offer varying levels of risk and potential reward.

Fixed Annuities

With Fixed Annuities, you know what to expect. The insurance company guarantees a minimum interest rate, giving you fixed income payments throughout your retirement. Since you know precisely what you’re going to get, it makes it easier to budget during retirement, as the income stream remains stable and predictable.

Fixed annuities provide a guaranteed minimum rate of return. They are considered a lower-risk retirement planning option. You may be able to add a death benefit to a fixed annuity that would pay out to your beneficiaries.

Variable Annuities

Variable annuities involve more risk but offer greater potential for growth. Unlike their fixed counterparts, returns on variable annuities are linked to the performance of the underlying investments you select. As you invest in various sub-accounts—similar to mutual funds—your payout fluctuates based on market performance.

Think of them like investing in a mutual fund. The amount you receive when you annuitize depends on the investment’s performance. While there’s a chance of earning more, there’s also the potential for losses.

Variable Annuities also allow you to choose among different investment options with varying levels of risk and potential returns. While variable annuities may have higher potential returns, they are also subject to market risk. This means that the value of your annuity can fluctuate and you could lose the principal invested.

Indexed Annuities

Indexed annuities blend aspects of fixed and variable annuities. The interest earned is tied to the performance of a market index, like the S&P 500, while still guaranteeing a minimum interest rate. They aim to provide some potential for growth while offering more security compared to a straight-up variable annuity.

The most commonly used index is the Standard & Poorâs 500 Composite Stock Price Index (S&P 500) . This is also known as a registered index-linked annuity. They typically have a guaranteed minimum rate of return.

It’s important to consider factors such as the participation rate (what percentage of the index gains are credited to your account) and potential caps on returns. It’s important to note that indexed annuities may not fully participate in market gains. They may also have caps on the maximum return you can earn.

Annuities Insurance: Factors to Consider

Like any significant financial decision, purchasing annuities requires careful consideration. Several factors can impact your decision-making process. Thinking through these helps you choose the annuity contract that meets your unique requirements. There are additional cost factors you may incur so it’s best to talk to an insurance professional.

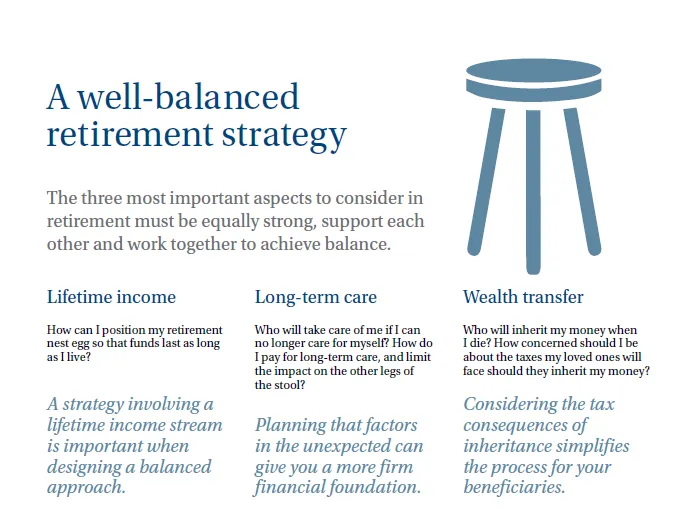

1. Your Retirement Goals and Risk Tolerance

It’s crucial to start with understanding your financial needs during retirement. How much income do you need to sustain your lifestyle? This is determined by your retirement expenses and projected income from other sources like life insurance or Social Security. It’s also important to factor in potential healthcare costs, long-term care needs, and inflation.

Then there’s your risk tolerance. Are you comfortable with some level of investment risk in exchange for potentially higher returns, or would you prefer a guaranteed income stream, even if it’s potentially lower? This introspection will guide your choice between fixed, variable, or indexed annuities.

2. Surrender Charges

It’s good to be prepared. But sometimes you need access to your money sooner. Many annuities insurance come with surrender charges. Surrender charges are penalties you incur if you withdraw your money during a certain period after buying the annuity.

These annuity surrender periods can be a few years. These penalties gradually decrease over time. Understanding the surrender charge period and the associated penalties is important to determine the liquidity of your investment.

3. Fees

Be aware that annuity insurance comes with different types of fees that vary depending on the company and specific policy. It’s crucial to be informed about these costs to make the right decision. It’s essential to factor in these costs when comparing different annuities.

These can include administrative expenses, rider charges, and management fees for variable annuities. Researching and understanding all associated costs beforehand ensures transparency in your financial planning. Consider the impact of fees on the overall return of your annuity.

4. Taxation

The IRS treats withdrawals from annuities as taxable income. But this applies only to the earnings portion, not the principal amount. Consult with a tax advisor to understand the tax implications of annuities based on your individual circumstances.

Additionally, you may face a 10% tax penalty on early withdrawals before reaching the age of 59 1/2. However, some exceptions may apply to certain situations like disability or death. It’s important to consult with a financial expert or tax professional to fully understand the tax implications of annuities.

The Role of the National Association of Insurance Commissioners (NAIC)

We’ve all been there: stuck in a sea of annuity options, desperate for solid advice from someone who truly knows their stuff. When you need it most, the NAIC is there to support consumers with top-notch resources.

By protecting consumers, it single-handedly turns weak state insurance regulations into strong ones. The NAIC tackles pressing insurance issues head-on by joining forces with industry leaders, digging into research, and setting standards that benefit everyone. Market conduct and insurance company regulation are just a couple of the big-ticket items on their agenda.

From guides that break down complex insurance topics to model laws and regulations, the NAIC’s resources have got you covered. It’s not just companies they work with – they publish informative content for the average consumer and regulatory agencies too. Whether you’re a seasoned pro or just starting out, a rich vein of data and insightful analysis can help you separate fact from fiction when it comes to insurance products like annuities.

Conclusion

Figuring out if annuity insurance is right for your retirement involves some serious number-crunching and benefit-weighing. Assess your situation: what are your non-negotiables, your preferences, and your resources? It’s time to prioritize. Make sure to speak with your insurance commissioner if you have questions.

Reach out to a financial advisor or insurance agent to discuss which product best suits your retirement needs. Remember to always review all the contract details, associated costs, and the financial health of the insurance company before buying annuity insurance. You’ll also want to make sure that any annuity you decide on aligns with your overall retirement plans, financial goals, and health insurance needs.

FAQ

What is an annuity?

An annuity is a contract between you and an insurance company. You give the company money, and they make payments to you, either right away or in the future. It’s kind of like a pension that you create for yourself.

What are the different types of annuities?

Lots of different types of annuities. But the main ones are:

- Fixed annuities

- Variable annuities

- Indexed annuities

Each type has a different level of risk and potential return.

How do I choose the right annuity?

Choosing the right annuity depends on several different factors. This includes your age, risk tolerance, and financial goals. It’s a good idea to talk to a financial advisor to find the best one for you.

What are the risks of annuities?

Annuities are generally considered to be safe investments, but there are some risks to keep in mind. For example, if you choose a variable annuity, your payments may go down if the stock market does poorly.

How do I buy an annuity?

You can buy an annuity from an insurance company through an experienced broker/ agent