If you’re pondering over ‘what is the difference between term and whole life insurance’, you’re looking at two key pathways in the realm of life coverage. Term life insurance is essentially a temporary solution, providing coverage for a set term.

Whole life insurance, on the other hand, is a permanent fixture, offering lifelong coverage and an investment component. This article elucidates the fundamental distinctions between them, helping you make a decision that best suits your financial blueprint.

Key Takeaways

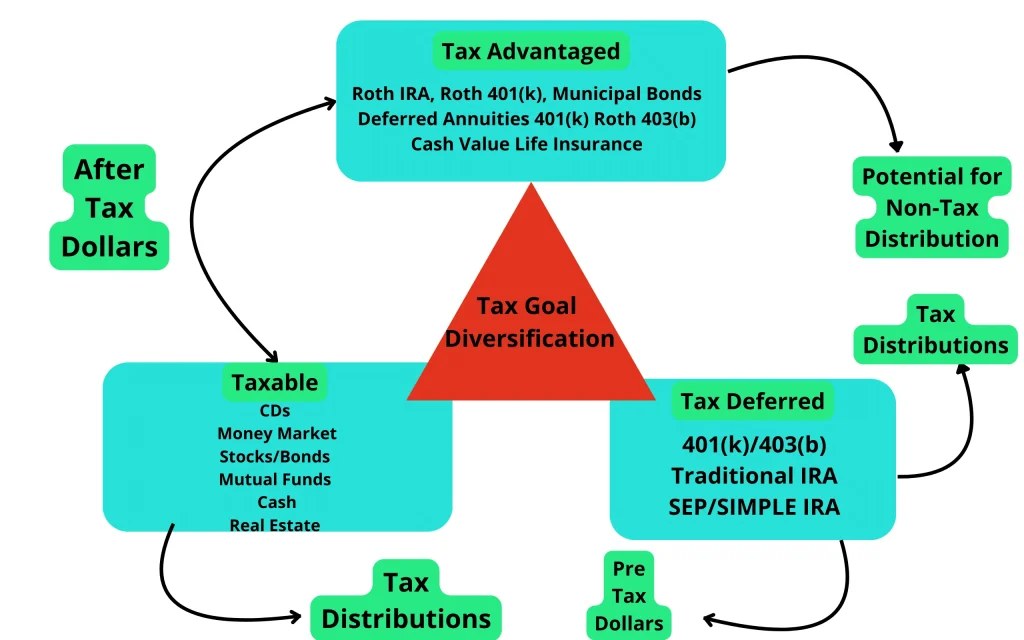

Life insurance plans fall into tax-qualified or non-tax-qualified categories. Tax-qualified plans like traditional IRAs and 401(k)s offer tax deductions and deferred growth but have contribution limits. Non-tax-qualified plans, such as Roth IRAs and certain life insurance products, lack upfront deductions but offer flexible contributions and tax-free withdrawals.

Term life insurance is more affordable and suitable for those needing coverage for specific timeframes. In contrast, whole life insurance offers Living benefits, guaranteed level premiums, death benefits, and a growing cash value component that can serve as a tax-free investment.

Choosing the right life insurance policy depends on personal financial needs, the desired period of coverage, and whether the policyholder prioritizes initial affordability or long-term value.

What is your lifestyle?

What are your lifestyle desires?

What are your current expenses?

What is your current cash flow?

Introduction: New Life Insurance Policy

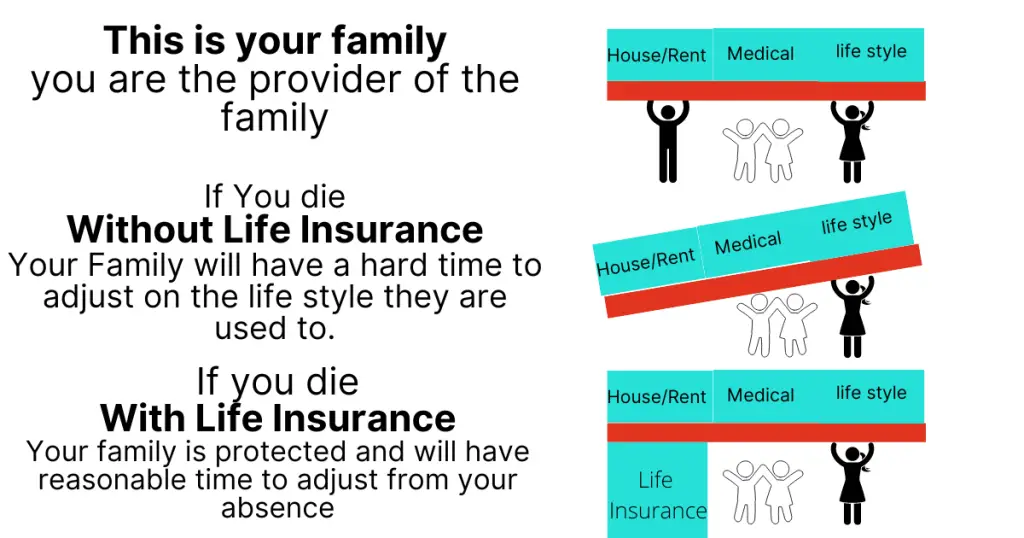

Life insurance should be considered as a core part of personal financial security. It offers a safety net tailored to individual needs and life stages. The choices you make—based on factors such as your health history, the need for a medical exam, and other factors—can have profound implications for your family’s future.

Next, we will unravel the complexities of life insurance and clarify the differences between term and whole-life coverage, aiding you in making an informed decision.

Term vs. Whole of Life Policy: What is the Difference Between Term and Whole of Life Insurance?

tax-qualified vs non-tax-qualified plans are based on following or not following ERISA guidelines.

There are two main types of life insurance to consider: term and permanent life insurance. Each serves a distinct purpose and offers different benefits.

Different Types of Life Insurance

Whole of life insurance provides a reliable financial base with premiums that stay the same throughout your life. For many people, paying more is worth it to have the comfort and long-term financial protection that doesn’t end.

Universal life insurance stands out for its flexibility, giving policyholders the power to tailor their coverage and premiums over time. The ability to adjust these factors, along with the potential for cash value growth linked to a stock market index, presents an attractive option for those seeking a balance between a permanent insurance policy and financial adaptability.

Indexed universal life insurance, Indexed universal life insurance, in particular, provides a financial safety net by ensuring that the policy’s cash value is protected against market downturns with a guaranteed zero percent floor.

Variable life insurance is for those who wish to blend insurance with investment potential. Policyholders can allocate their premiums across investment options aiming for higher returns. However, this approach comes with increased risk, and factors like fees and expenses can significantly affect the policy’s performance. This type of policy requires a proactive approach to management and a clear understanding of the associated risks and rewards.

Choose Term Life Insurance

Term life policy is the financial defender for a certain period—often aligning with life’s financial responsibilities.

Whether it’s a 30-year mortgage or the early years of your children’s lives, term coverage offers affordable coverage that matches your life’s timeline with your liabilities.

With its lower premiums, term life insurance policies are the choice for those seeking an economic solution to protect their family’s future without committing to a lifelong policy, such as a whole life insurance policy.

Permanent Life Insurance Policy: Guaranteed cash value

The permanence of a whole of life insurance policy lies not only in its lifetime coverage but also in its role as a financial planning tool. Its guaranteed death benefit generally provides tax-free transfer, and the cash value component serves as a tax-free savings account.

Whole of life policy, on the other hand, offers Living benefits, guaranteed level premiums, death benefits, and the ability to accumulate cash value tax free savings component.

Additionally, depending on whether the insurance company operates on a non-participating or participating basis, policyholders may be eligible for annual dividends on top of the guaranteed yearly contract percentage.

Whole of Life insurance is the only way to ensure that what you want to happen, will happen when you want it to happen, whether you are there to witness it or not.

Comparing Coverage Duration

Term and whole life policy differ significantly in terms of coverage duration. Term life insurance provides coverage for a specific period, while a whole life policy offers coverage for the entire lifetime of the policyholder.

Term life is bound by time, offering protection for a predetermined period, such as 10, 20, or 30 years. On the flip side, whole life insurance promises coverage that endures for your entire life, providing a financial legacy that can even extend beyond your lifetime.

This essential difference is a critical consideration when choosing between term and permanent life insurance options.

Characteristics of Term Life Insurance

Term life insurance is a type of temporary life insurance that provides coverage for a specified period, typically ranging from 10 to 30 years. This type of insurance is ideal for individuals who want coverage for a specific period, such as until their children are grown and self-sufficient or until their mortgage is paid off.

Key characteristics of term life insurance include:

- Coverage for a specified period: Term life insurance policies offer coverage for a set term, such as 10, 20, or 30 years.

- Stable premiums: Premiums remain the same for the life of the policy, making it easier to budget for.

- No cash value component: Unlike whole life insurance, term life does not accumulate cash value.

- Death benefit: The policy pays out a death benefit if the policyholder passes away during the term.

- Affordability: Generally, term life insurance is less expensive than whole life insurance, making it an attractive option for those seeking cost-effective coverage.

Characteristics of Whole Life Insurance

Whole life insurance, also known as permanent life insurance, provides coverage for the policyholder’s entire life, as long as premiums are paid. This type of insurance is ideal for individuals who want lifetime coverage and a guaranteed death benefit.

Key characteristics of whole life insurance include:

- Lifetime coverage: Whole life insurance offers coverage for the policyholder’s entire life, ensuring a death benefit is paid out regardless of when the policyholder passes away.

- Stable premiums: Premiums remain the same throughout the life of the policy, providing predictability in financial planning.

- Cash value component: Whole life insurance includes a cash value component that grows over time, which can be accessed through loans or withdrawals.

- Death benefit: The policy guarantees a death benefit to beneficiaries upon the policyholder’s passing.

- Higher cost: Whole life insurance is generally more expensive than term life insurance due to its lifetime coverage and cash value component.

Financial Implications: Buying Life Insurance

Understanding the financial implications of life insurance premiums is crucial. Term life insurance is cost-effective, offering temporary protection without an investment feature.

Whole life insurance, does cost more due to its lifelong coverage and cash value component, which provides life premiums.

Age, health, and coverage amount significantly influence life insurance costs, whether a whole or a term life policy.

Initial Costs, Death benefit amount,

Term life insurance greets you with lower initial premiums, reflecting its limited coverage period and absence of an investment feature. However, keep in mind that if you choose to renew your policy, the premiums could rise sharply as you age, mirroring the increased risk to the insurer.

Unlike term life insurance, the key differences in whole life premiums remain constant, offering a predictable expense throughout your life. This stability can be especially appealing for those looking to incorporate their life insurance policy into long-term financial planning.

How to be Approved for Life Insurance

During the approval process for both term and whole life insurance, insurers may review your medical history through the Medical Information Bureau (MIB), which helps them determine the risk of insuring you and set your premium rates accordingly.

This check is a standard part of the underwriting process, which may also include a physical exam, blood tests, and a review of your lifestyle, including hobbies and habits that could impact your health.

The information gathered during this process enables insurers to assess the level of risk they would take by providing you with a policy and to calculate the premiums that you would pay for your coverage.

It’s important to be truthful and thorough when providing information, as inaccuracies or omissions could affect your coverage or lead to denial of a claim.

Strategic Considerations: Term or Whole Life Coverage

Strategic selection of your life insurance policy includes:

What is your lifestyle?

What are your lifestyle desires?

What are your current expenses?

What is your current cash flow?

All of these factors are important in your decision-making process.

Term Life Insurance Benefits

Aligning your life insurance policy with your current values is a sensible approach to ensuring adequate protection. Here are some options to consider based on your needs:

Young individuals might prefer term life for its affordability.

Those with established financial obligations may opt for a longer-term policy with level premiums.

Staggering multiple policies can match your coverage with your diminishing financial liabilities over time.

Choosing decreasing-term life insurance can also help match your coverage with your diminishing financial liabilities over time.

Life insurance is not one-size-fits-all, and there are ways to customize your coverage to fit your unique needs. Some carriers also carry convertible term policies that offer the flexibility to transition to permanent coverage without a new medical exam.

Insurance companies also offer customization based on personal circumstances and changing life events. This personalization ensures that your life insurance coverage evolves with you.

Whole Life Insurance Policy Benefits

Whole life insurance, with its lifelong coverage and cash value benefits, might be the right choice for those thinking about legacy and long-term financial stability, especially when considering whole life insurance policies.

Whole life insurance’s cash value component sets it apart from term life, offering a savings account that grows tax-free. Accessing this cash value can fund education, supplement retirement income, or meet other financial goals, enhancing the policy’s role in your personal finance strategy.

The potential for the policy to become paid up, ending the need for premium payments while retaining coverage, further underscores the growth and savings opportunities that whole life insurance can provide.

Whole life policy also carries living benefits that help cover health emergencies such as Terminal illness & Chronic illness.

Understanding these aspects of your policy is crucial for leveraging life insurance as part of a comprehensive financial strategy.

Real Examples of Term Insurance vs Whole Life Insurance: A Comparative Look

Term vs. Whole Life Insurance: A Comparative Introduction: Imagine Steven and Hannah, a forward-thinking couple, as they navigate the decision between term and whole life insurance. With term life insurance, they could secure a financial safeguard for a defined period, perfectly aligning with their temporary needs like a mortgage or their children’s education years.

On the other hand, whole life insurance offers them lifetime coverage with living benefits and a cash value account, growing over time and serving as a financial asset for emergency needs or as part of their retirement strategy.

The pros of term life insurance include lower initial premiums, making it an affordable option for temporary coverage during critical financial periods. Additionally, term life policies can be tailored to match the time frame of specific debts or educational expenses for dependents.

On the cons side, term life insurance does not build cash value, and once the term expires, renewing the policy can often come at a significantly higher cost due to increased age or changes in health status. The policy is only beneficial if the insurer graduates from this life.

In contrast, the pros of whole life insurance include permanent coverage, living benefits, riders, and the accumulation of a cash value account, which can serve as a financial asset and be used for loans or withdrawals. This can make whole life insurance a valuable component of a long-term financial strategy. The living benefits & cash value of a whole life allow for access to funds to be able to solve life’s emergencies before graduating from this life.

the cons are higher premiums compared to term life and less flexibility in terms of adjusting the coverage amount or premium payments.

In both applications, Lisa and Mark are focused on protecting their family’s future, but they choose different policies based on their long-term financial strategies and the pros and cons associated with each type of policy.

Expert Insights: Consulting with a Licensed Insurance Agent

Navigating the intricacies of life insurance can be simplified with the guidance of a certified life insurance agent with the ability to structure policies correctly.

As a professional in the field, we provide valuable insights tailored to your circumstances and can help you find solutions that are tailored to you.

With our expertise, we can help guide you, ensuring that your life insurance policy aligns with your financial goals and provides the necessary protection for your family.

The Role of Life Insurance Companies in Policy Selection

The selection of a life insurance company significantly influences your policy choice. It’s crucial to understand the difference between a mutually funded company and stockholders for dividend payout, but also the company’s financial performance to the duration of the policy.

A mutually funded life insurance company is owned by its policyholders, and any profits are typically redistributed back to them in the form of dividends or reduced premiums.

This mutual structure means that policyholders can often have a say in company decisions and may benefit directly from the company’s financial success.

In contrast, a stock life insurance company is owned by shareholders who invest capital into the business. Profits generated by the company are distributed as dividends to these stockholders, rather than to policyholders.

This means that policyholders will not receive direct financial benefits from the company’s profits, but they can potentially benefit from the company’s focus on efficiency and growth, driven by the goal of increasing shareholder value.

When choosing between a mutually funded or stockholder-owned life insurance company, it’s important to consider factors such as the company’s financial stability, How many years they have been established, customer satisfaction levels, and how profits are distributed.

Companies with strong financial strength ratings and positive customer feedback can provide confidence in your choice, whether they are mutually funded or stockholder-owned.

These metrics indicate a company’s ability to fulfill its obligations and its commitment to serving its policyholders effectively.

Summary

In summary, understanding the intricacies of term and whole life insurance is critical for making informed decisions that shape your financial future. Whether you prioritize affordability, flexibility, or the potential for cash value growth, there is a life insurance policy to meet your needs.

Consulting with a licensed insurance agent and selecting a reputable insurance company can enhance your confidence in your life insurance choices. Remember, the right life insurance policy is a commitment to the well-being of your loved ones and a cornerstone of your financial legacy.

Frequently Asked Questions

Do you get your money back at the end of a term life insurance?

No, you do not get your money back at the end of a term life insurance policy, as it only pays out a death benefit that occurs during the fixed period.

What is the disadvantage of whole life insurance?

The disadvantages of whole life insurance include higher premiums & medical approval takes time to be insured.

Which is better whole life or term life insurance?

Whole life insurance is better if you need permanent coverage and a cash value component, whereas term life insurance is more affordable if you only need coverage for a period of time, but typically don’t expect to use it. Consider your needs and preferences before deciding on the type of insurance.

What factors should I consider when choosing between term and whole life insurance?

When choosing between term and whole life insurance, consider your financial obligations,life expectancy, coverage length, health history, and the cash value component. These factors will help you make an informed decision.

Can I customize my life insurance policy?

Yes, insurance companies offer customizable policies with riders and options to tailor coverage to your specific needs and life stages. You can customize your life insurance policy.

Are Life Insurance policies an investment with the cash value growth?

No, Insurance policies are used to help with risk protection, they are not an investment, insurance companies also have limitations on funding and death benefit based on your income.