Want to know how to sell life insurance? You’ve seen the ads and heard the pitches, but something isn’t clicking. It’s understandable. This isn’t about pushing a product – it’s about helping people secure their financial future. But in a world saturated with insurance options, selling life insurance successfully requires strategy, empathy, and industry knowledge.

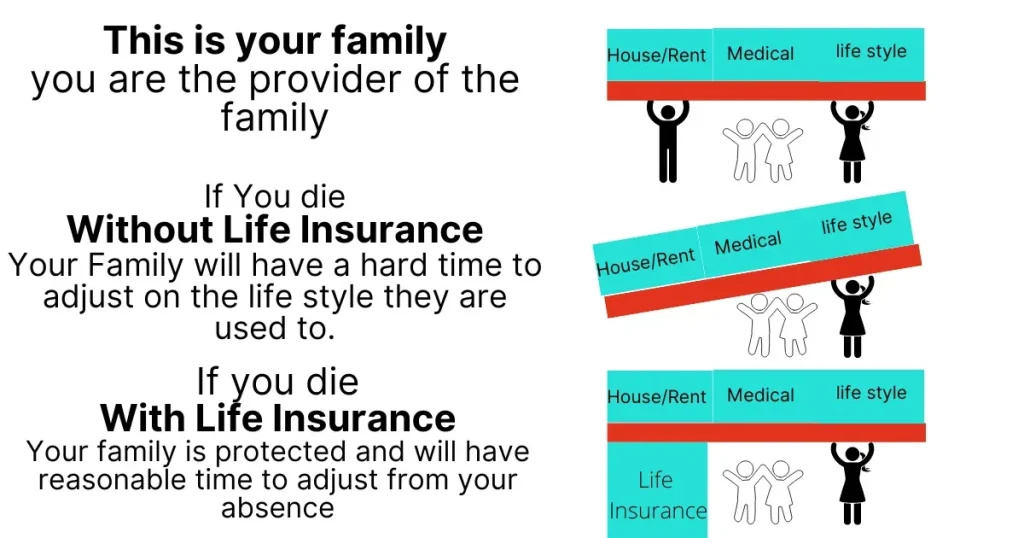

Let’s face it – talking about death makes people squirm. This is where you become a guide, not a salesperson. Show them how life insurance offers a safety net for loved ones and protects their family’s financial future. You’re not peddling fear, but responsibility. This approach resonates and turns a difficult topic into a conversation about caring for those who matter.

Table of Contents:

- Becoming a Life Insurance Agent

- Building Your Sales Strategy

- Understanding Life Insurance Products

- Building Long-Term Client Relationships

- Conclusion

- FAQs about how to sell life insurance

- Is life insurance hard to sell?

- How do you make money from selling life insurance?

- How much do you get for selling a life insurance policy?

- Is selling life insurance a good hustle?

- How do I get my first clients as a new life insurance agent?

- What continuing education requirements do I need as a life insurance agent?

- Should I become a captive or independent life insurance agent?

- How long does it typically take to become successful selling life insurance?

- Can I sell life insurance part-time while keeping my current job?

Becoming a Life Insurance Agent

First things first – you can’t sell what you don’t understand. Just like any career worth having, a career as an insurance agent starts with proper education. This ensures you’re giving clients accurate information and positions you as a trustworthy advisor.

Licensing and Education Requirements

Before you can start connecting with clients and building your book of business, you’ll need to obtain your life insurance license. Each state has specific pre-licensing education requirements, so check with your state’s insurance department for details. Here’s what to expect as you embark on your insurance career.

Pre-Licensing Education

This step provides the foundation for understanding life insurance policies. You’ll dive into insurance basics – policy types, regulations, and ethics. Look for pre-licensing courses online or through accredited institutions to learn about insurance coverage. This investment in your education will be worth it. By the end, you’ll be able to explain complex concepts to future clients in a way they can understand.

Licensing Exam

This is the test that lets you put all that freshly gained knowledge to the test. You’ll face a state-administered exam covering life and health insurance concepts, laws, and regulations. Preparation is key, and there are plenty of resources available to help you ace the test, from study guides to practice exams.

Background Check

Because financial matters demand integrity, expect a background check. It’s all about ensuring you’re a trustworthy professional.

Building Your Sales Strategy

Once you’re a licensed insurance agent, it’s time to craft your strategy. It’s one thing to know how to sell life insurance; it’s another to attract clients and tailor your approach to their individual needs.

Identify and Understand Your Target Market

Are you targeting young families just starting out? Or maybe seasoned professionals seeking wealth preservation strategies? Tailoring your approach is essential. Consider permanent life insurance as an option for those looking for long-term financial stability. MetLife, for example, uses data analytics in its customer research to pinpoint specific demographics, like age, income levels, and employment types. This targeted approach isn’t about being exclusive. It’s about making genuine connections with those who would most benefit from your services.

Mastering the Art of Communication

Being a good salesperson is as much about listening as it is about speaking. Here are some conversational tips to master:

- Ask the Right Questions: Instead of leading with a sales pitch, engage in meaningful conversation. What are their financial goals? Do they have dependents? By actively listening, you uncover needs and tailor solutions accordingly.

- Emphasize Value, Not Just Features: Highlighting the benefits of coverage resonates far more than simply listing policy features. Focus on peace of mind, debt protection, and securing a family’s financial future.

- Use Everyday Language: Ditch the industry jargon. When you speak your client’s language, they understand the value proposition more clearly, which can help seal the deal.

Leveraging Technology to Your Advantage

We’re in a digital age, and that extends to how people research and buy life insurance. A 2020 study by LIMRA revealed that the percentage of consumers buying life insurance online jumped by a whopping 12% compared to 2011. This highlights a trend we see across industries—more and more consumers are choosing the convenience and ease of digital shopping experiences. That means your digital game needs to be strong.

Embrace Social Media

Think social media is just for sharing vacation photos? Think again. In the context of how to sell life insurance, it can be a goldmine. LinkedIn, for instance, is a powerful tool for connecting with professionals and businesses. Use it to build relationships, engage in industry conversations, and position yourself as a thought leader. This isn’t about spamming your network with sales pitches. Instead, think of social media as a way to nurture relationships that can organically turn into clients over time.

Understanding Life Insurance Products

Knowing the ins and outs of different life insurance policies allows you to recommend the right option for each client’s situation.

Term Life Insurance

Term life insurance is like renting coverage – it’s affordable and ideal for temporary needs, like covering a mortgage or providing financial support until children finish college. Term life insurance policies typically provide coverage for a set period, such as 10, 20, or 30 years.

Whole Life Insurance

Life insurance, especially whole life insurance, offers lifelong coverage and typically comes with a savings component, known as cash value. Premiums are usually higher but remain fixed. Life insurance options like this appeal to clients seeking long-term financial stability.

Universal Life Insurance

Want flexibility? This is it. With universal life insurance, you can often adjust premium payments and death benefits, making it adaptable to changing needs. Life insurance is only one part of a financial strategy—this adaptability makes it a valuable option.

Building Long-Term Client Relationships

Don’t underestimate the power of word-of-mouth marketing. When clients feel heard, valued, and well-taken care of, they often refer friends and family to you. Repeat business and referrals form the cornerstone of a successful insurance practice. Think about how you want people to describe you as an agent—responsive, helpful, trustworthy. These qualities are important for building trust and rapport with clients. Those are qualities that keep clients coming back for more and recommending your services.

Conclusion

Mastering how to sell life insurance is a rewarding endeavor, one that goes beyond mere transactions to provide genuine security and peace of mind for families. It combines the essential elements of education, empathy, and communication. By understanding the intricacies of insurance policies, connecting with potential clients on a personal level, and leveraging technology to your advantage, you can build a successful and fulfilling career in the life insurance industry.

FAQs about how to sell life insurance

Is life insurance hard to sell?

While it presents its challenges, life insurance doesn’t have to be inherently hard to sell. Focusing on building trust, actively listening, and tailoring your approach to individual needs are great first steps. You’re essentially helping families safeguard their future, which is a powerful value proposition.

How do you make money from selling life insurance?

Typically, you earn through commissions based on the policies sold. These commissions are a percentage of the premium paid by the policyholder. The more policies you sell and the higher the premium amounts, the greater your earning potential.

How much do you get for selling a life insurance policy?

This varies significantly based on factors such as the type of policy (term, whole life, universal), the size of the death benefit, and the commission structure offered by the insurance carrier you’re contracted with. It’s best to inquire directly with specific companies to get accurate commission details for their life insurance plans.

Is selling life insurance a good hustle?

The short answer is, it depends. While you have the potential to earn a high income through life insurance sales, particularly for dedicated, client-focused agents, it does require specific skills. You need to be comfortable discussing sensitive topics, managing a flexible work schedule (often with long hours, especially at the start), and building a client base often through self-promotion. However, many find the combination of financial rewards, helping others, and being your own boss extremely fulfilling.

How do I get my first clients as a new life insurance agent?

Getting your first clients as a new life insurance agent typically starts with your natural market – friends, family, former colleagues, and people in your existing network who already know and trust you. While some agents hesitate to approach their personal network, these warm contacts often become your foundation for building credibility and gaining valuable sales experience. Beyond your immediate circle, consider joining local business networking groups, chambers of commerce, or professional associations where you can meet potential clients and referral partners. Many successful new agents also leverage social media platforms like LinkedIn to share educational content about life insurance and connect with prospects in their target market. Additionally, ask your insurance agency or brokerage about lead generation programs they may offer – many companies provide new agents with leads or training on how to generate them through digital marketing, direct mail, or cold calling. Most importantly, ask every satisfied client for referrals, as word-of-mouth recommendations from happy customers become increasingly valuable as you build your reputation. Remember that building a client base takes time and persistence, so focus on providing exceptional service to early clients who can become advocates for your business.

What continuing education requirements do I need as a life insurance agent?

As a licensed life insurance agent, you must complete continuing education requirements to maintain your license, with specific requirements varying by state. Most states require agents to complete twenty-four hours of continuing education every two years, which typically includes two to three hours of ethics training covering topics like fraud prevention and professional conduct. Some states have different renewal periods ranging from one year to four years, so it’s essential to check your specific state’s insurance department requirements. The continuing education courses usually cover life and health insurance topics including product knowledge, regulatory changes, insurance law updates, and industry trends. Many states participate in the National Association of Insurance Commissioners continuing education reciprocity agreement, which means if you hold licenses in multiple states, you often only need to complete your resident state continuing education requirements. You can take these courses through various formats including in-person classes, live webinars, or self-paced online courses from state-approved providers. Most course providers will automatically report your completed credits to your state insurance department, though it’s your responsibility to verify the credits were received and to keep certificates of completion for at least five years. Missing continuing education deadlines can result in your license becoming inactive or expired, requiring you to complete all outstanding requirements plus potentially retake prelicensing courses and exams to reinstate your license. It’s recommended to complete your continuing education at least ninety to one hundred twenty days before your license expiration date to allow time for processing.

Should I become a captive or independent life insurance agent?

Choosing between becoming a captive agent or an independent agent is one of the most important career decisions you’ll make in life insurance sales, as each path offers distinct advantages and challenges. Captive agents work exclusively for one insurance company and sell only that company’s products, receiving benefits like base salary plus commission, comprehensive training programs, office space and administrative support provided by the parent company, strong brand recognition from the company’s marketing efforts, and typically lower startup costs. However, captive agents face limitations including restricted product offerings that may not always meet every client’s needs, lower commission rates compared to independent agents, potential sales quotas they must meet, less autonomy in business decisions, and sometimes noncompete agreements that restrict future career moves. Independent agents have the flexibility to represent multiple insurance carriers and offer clients a wider variety of products from different companies, allowing them to shop around for the best rates and coverage options for each client. Independent agents typically earn higher commissions per sale, have complete control over their business operations and work schedule, can build their own brand, and aren’t bound by noncompete agreements. The tradeoffs include higher startup costs for licensing multiple carrier appointments and establishing an office, sole responsibility for marketing and lead generation without corporate advertising support, the administrative burden of managing relationships and paperwork with multiple carriers, income variability especially when starting out, and needing to be more self-motivated and entrepreneurial. Many new agents start as captive agents to gain experience, training, and a steady income before transitioning to independent agent status once they’ve built confidence and industry knowledge. Your decision should consider your financial situation, risk tolerance, desire for independence, sales experience, and long-term career goals.

How long does it typically take to become successful selling life insurance?

The timeline to become successful as a life insurance agent varies significantly based on multiple factors, but most industry experts suggest that building a sustainable, profitable practice typically takes one to three years of consistent effort. The initial licensing process itself usually takes one to three months including completing prelicensing education, passing your state exam, and obtaining appointments with insurance carriers. During your first year, expect to focus heavily on learning products, developing your sales skills, building your initial client base from your natural market of friends and family, and establishing prospecting systems. Many new agents struggle financially during the first six to twelve months as they learn the business and wait for commission payments to materialize, which is why having financial reserves to cover living expenses for at least six months is crucial. Success timelines depend greatly on factors including whether you work full-time or part-time, your previous sales experience, the quality of training and mentorship you receive from your agency, your ability to consistently generate leads and conduct appointments, your natural network size and how willing you are to prospect it, the amount of startup capital you have for marketing, and your persistence through inevitable rejection. Agents with strong networks and prior sales experience may start earning decent income within six months, while those starting from scratch might take eighteen to twenty-four months to reach sustainable income levels. By year two to three, successful agents typically have developed consistent referral sources, repeat clients for policy reviews and additional coverage, and refined prospecting and sales processes that generate predictable income. Industry statistics show that many new agents don’t survive past the first year, often due to insufficient financial reserves, lack of proper training, or giving up too early before their efforts compound into success.

Can I sell life insurance part-time while keeping my current job?

Yes, you absolutely can sell life insurance part-time while maintaining your current employment, and many successful agents actually start this way to test the waters and build their business gradually without the financial pressure of relying solely on commission income. Part-time life insurance sales can be an excellent side income opportunity or transition strategy into a full-time insurance career. The flexibility of insurance sales makes it particularly suitable for part-time work because you control your own schedule, can conduct appointments during evenings and weekends when many clients are available, and can work remotely meeting clients at their homes, offices, or via phone and video calls. Many insurance agencies and brokerages specifically recruit part-time agents and understand that building a book of business takes time. To succeed selling insurance part-time, you’ll need to be highly organized with your time, set specific hours dedicated to insurance activities each week such as ten to twenty hours consistently, focus on efficient lead generation methods that don’t require constant availability, leverage technology and social media for marketing, and be transparent with clients about your availability while still providing excellent responsive service. Some practical considerations include checking whether your current employer has any policies against outside employment or conflicts of interest, ensuring you have enough time for required continuing education, understanding that building momentum may take longer part-time than full-time, and being realistic that income growth will be proportional to time invested. Many part-time agents focus initially on their warm market and referrals which require less cold prospecting time, sell primarily during evenings and weekends, and use their full-time job stability to weather the initial slow income period. Some agents remain part-time indefinitely enjoying supplemental income of twenty thousand to fifty thousand dollars annually, while others use part-time sales as a proving ground and transition to full-time once their insurance income matches or exceeds their regular job income.