People often wonder about how to get life insurance. Maybe they just graduated college or welcomed a new baby, prompting them to think about securing their loved ones’ futures. But what exactly is life insurance, and is it something everyone needs? This guide helps you understand why you might want a life insurance policy, what kinds of life insurance options are out there, and the steps you need to take to get coverage. This way, you can navigate this essential decision confidently.

Table of Contents:

- Why Life Insurance is Important

- Types of Life Insurance Explained

- Determining Your Life Insurance Needs

- Navigating the Life Insurance Purchase Process

- Conclusion

- FAQs about how to get life insurance

Why Life Insurance is Important

Most people benefit from having life insurance. It acts as a safety net for your family or chosen beneficiaries, offering financial protection after you die. Imagine this – if your income stopped today, what would your family do?

How would they manage bills, the mortgage, or even daily living expenses? This is where life insurance steps in, providing a payout to your loved ones to use as needed.

But what if you’re single or don’t have dependents? Life insurance can still make sense. Maybe you have co-signed loans, want to leave a gift to a sibling or want access to permanent life insurance. It could even cover end-of-life expenses like a funeral, preventing a financial burden on someone else. The point is – life insurance isn’t just for those with kids and spouses. Think about what financial impact your absence would have and if a policy can fill that gap.

Types of Life Insurance Explained

When considering how to buy life insurance, it’s crucial to understand the different policy terms available: term life insurance and permanent. The ideal choice for you often depends on your financial situation, credit cards, and future goals. Let’s break down the distinctions.

Term Life Insurance

Term life insurance is straightforward – it covers you for a chosen period, usually 10, 20, or 30 years. If you die within that term, your beneficiary receives a lump-sum death benefit.

You can liken this to renting an apartment – coverage lasts for the lease (the term), and then it’s over. It’s ideal for temporary needs, like covering your mortgage until it’s paid off or your kids’ college expenses.

Term life tends to be the most affordable option to buy life insurance because it’s only designed to provide coverage for a specific period, not your entire life.

Permanent Life Insurance

Permanent life insurance is like owning a house. Coverage is meant to last your lifetime as long as you pay your premiums. Plus, many permanent life insurance policies build cash value over time, almost like a savings account.

This is a savings component that you can withdraw from or borrow against, almost like a side investment. Because permanent coverage lasts much longer and often offers cash value features, it’s generally more expensive than term life.

Determining Your Life Insurance Needs

Understanding how to buy life insurance starts with figuring out how much you need. Sit down and realistically evaluate your financial obligations, student loans, and long-term goals. Imagine yourself leaving a comfortable situation behind for your loved ones – that’s what you’re aiming for.

Financial Obligations:

Outstanding debts: This includes mortgages, personal loans, car loans, auto loans, and any credit card debt. Think – what do you want covered so your family doesn’t inherit your financial burdens?

Income Replacement: Consider how many years you want to replace your income to support your family’s living expenses. What income would they be losing when they pass? Would a one-time lump sum from a life insurance company provide enough?

Long-Term Goals

College Expenses: Planning for a child’s college tuition requires considerable foresight. Buying a life insurance policy can ensure they pursue higher education.

Future Savings: Do you hope to leave an inheritance? Maybe there are philanthropic goals or even simply adding a boost to your family’s long-term savings. Life insurance can serve these aims, too.

How much life insurance is too much?

While adequate insurance coverage is essential, excessive coverage leads to unnecessarily high premiums. Finding a good balance between coverage and affordability is vital when comparing quotes for a life insurance policy.

Navigating the Life Insurance Purchase Process

Knowing how to get life insurance doesn’t stop with choosing the type and amount of coverage. There’s a practical side to things as well. Let’s explore these steps.

Choosing an Insurance Company

There are plenty of life insurance companies, but that doesn’t mean they’re all equal. It’s time to get discerning, just as you would when choosing any other financial product or service. Research a company’s financial strength before you get a quote for a policy.

Financial Strength Ratings: Reputable rating agencies like AM Best or Standard & Poor’s give you an idea of how well a company is doing financially. These agencies are like your behind-the-scenes researchers, offering objective insight into the insurance provider’s strength.

Consumer Reviews and Feedback: Check what other customers say on sites like J.D. Power. Have people had a smooth claims process, or do problems abound? Word of mouth (even digital.) can reveal a lot about a company.

Gathering the Necessary Information

Before you apply for life insurance, collect essential personal and financial information. This speeds things along, making the application process less daunting.

| Required information for life insurance: | |

|---|---|

| Social Security number: | Your SSN helps companies verify your identity during the application process. |

| Driver’s license number: | This acts as a supplemental identifier for many applications. |

| Date of birth: | Your birthdate allows for more accurate risk assessment and age-based calculations. |

| Marital status | Understanding if you’re single, married, widowed, or divorced plays a role in eligibility and rates. |

| Occupation | Your job, whether risky or office-based, can affect premium amounts. |

| Health and medical history: | Expect questions on existing health conditions, prior surgeries, and even family history. Transparency on medical details is essential. |

| Financial details (salary, assets) | Your financial status can impact the amount of coverage you’re able to secure and how much you’ll be paying for the policy. |

The Medical Exam

Most traditional life insurance policies require a medical exam, usually conducted by a nurse. They take measurements (like weight and blood pressure), ask lifestyle questions, and gather blood and urine samples. It’s like a snapshot of your current health to assess risk.

While some companies offer “no-medical exam” policies, keep in mind that these may come with higher premiums, reflecting increased uncertainty.

Choosing a Beneficiary

Don’t forget this critical step. Designate your beneficiaries, those individuals (or a trust or charity) who receive the life insurance payout upon your passing. Remember, you’re choosing who benefits from the protection your policy offers. Clearly state their full names and relationship to you.

Paying Premiums and Managing Your Policy

Once your policy is approved, set up a regular premium payment system that works best for you (online or snail mail, whichever’s your style.). Most companies allow various methods – online payments, automatic deductions, or traditional paper checks.

It’s wise to understand the implications of missed payments and the potential policy lapses. Keep tabs on policy updates or premium changes over time and stay organized.

Conclusion

Learning how to get life insurance might seem a bit overwhelming, especially if you’re new to all this financial stuff. But take a deep breath because securing this type of coverage isn’t as hard as you might think. By taking a step-by-step approach, determining your unique needs, researching insurance companies, and staying informed, you can make a decision that aligns perfectly with your current life situation and future goals.

FAQs about how to get life insurance

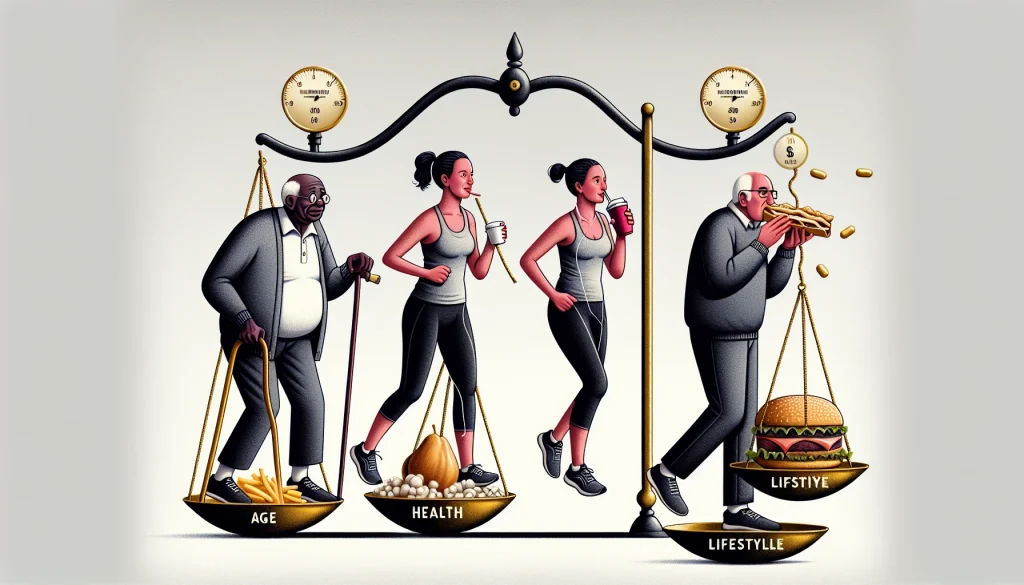

How do you qualify for life insurance?

Qualifying for life insurance is based on factors such as your age, health, occupation, lifestyle choices (like smoking), and financial history. The insurer looks at these factors to understand the level of risk associated with covering you. You usually fill out a detailed application, possibly undergo a medical exam, and may have a phone interview to finalize the process.

How do you get life insurance for yourself?

It’s all about researching companies, comparing quotes, and filling out an application with a chosen insurer. This usually involves a medical exam. To simplify this process, work with an insurance agent or broker. They’ll act as your guide, helping you pick the best policy that aligns with your situation.

How much does it cost to get life insurance?

There’s no one-size-fits-all answer regarding life insurance costs. It depends on several variables – your age (generally, younger people pay less because of statistically longer lifespans), the type of policy (term or permanent), your health status, the amount of coverage desired, and lifestyle habits. Think of it as a personal mix – insurers create your rate based on these ingredients.

How much is $100,000 in life insurance a month?

The cost of $100,000 in life insurance depends, just like with larger amounts. Your age and overall health greatly impact this monthly price. However, a relatively healthy person under 40 could potentially find a term life policy at that coverage amount for somewhere between $15-$30 a month. Remember, you’re not paying to ‘own’ death benefit (that wouldn’t make much sense). Instead, your premium covers the insurer’s promise to provide financially for your loved ones once you’re gone.

Can someone get life insurance on you without your permission?

No, someone cannot legally take out a life insurance policy on you without your knowledge and explicit consent. Every state requires that the insured person provides their consent before a policy can be issued. The application process requires your signature, personal information (like your Social Security number), and typically a medical exam. Additionally, the person taking out the policy must prove they have an “insurable interest” in you, meaning your death would cause them financial hardship. Taking out life insurance on someone without their permission is considered insurance fraud and is punishable by law. If you discover someone has attempted to take out a policy on you without consent, you should immediately contact the insurance company and your state’s insurance department to report the fraudulent activity.