Turning 18 marks a significant milestone—you’re officially an adult. This new independence also brings about questions like, “Do You Need Life Insurance at 18 with no debt or dependents, do you need life insurance? Why?”. It might seem unnecessary; after all, no one depends on your income yet.

However, the decision to purchase a life insurance policy, even at this early stage, requires thoughtful consideration. While the immediate financial impact of your death may be minimal, several crucial factors can help you determine whether life insurance aligns with your current financial picture.

Table Of Contents:

- Understanding the Purpose of Life Insurance

- The Case for Minimal or No Coverage

- Scenarios Where Some Coverage Might Be Beneficial

- Evaluating Your Financial Position

- Conclusion

- FAQs about if you are 18 years old with no debt or dependents do you need life insurance? why?

Understanding the Purpose of Life Insurance

Before delving into the specifics for 18-year-olds with no debt or dependents, let’s break down how life insurance works. At its core, it’s a contract.

You pay premiums to insurance companies, and in return, they promise to pay a sum of money—the death benefit—to your chosen beneficiaries upon your passing. This financial safety net can help those left behind cope with lost income, cover expenses, and manage any outstanding debts or liabilities they leave behind.

The Case for Minimal or No Coverage

If you are 18 years old with no debt or dependents, opting for minimal or no life insurance coverage might make sense in your current situation. Since you have no spouse, children, or other individuals relying on your income, a large policy to replace your earnings isn’t a necessity.

The logic is straightforward; if no one relies on your income, a life insurance payout won’t be replacing lost wages. Additionally, if you don’t have outstanding debts, such as a mortgage or student loans, a life insurance policy wouldn’t be needed to prevent financial burdens from being passed on.

At this stage in your life, you likely have a lower income and fewer expenses, making it easier to manage costs like potential funeral expenses without the financial burden of insurance premiums.

Scenarios Where Some Coverage Might Be Beneficial

Although needing life insurance at 18 without dependents or debt is less common, it’s not unheard of. Some situations could make considering at least a small life insurance policy a worthwhile move, even with no one depending on your income:

Covering Final Expenses

While no one wants to think about their mortality at 18, funeral expenses are a reality that will eventually need to be addressed. Funeral costs can be substantial, potentially placing a financial burden on your loved ones.

Final expense insurance, often referred to as burial insurance, is a smaller life insurance policy that specifically aims to alleviate this burden, ensuring your family won’t face additional stress during a difficult time.

Student Loan Considerations

Student loans are a common debt. While federal student loans are often discharged upon death, the same is not always true for private loans.

Depending on the terms, cosigners on the loan, such as parents, could be responsible for the remaining balance. A life insurance policy can act as a safety net, ensuring your loved ones won’t inherit your debt.

Taking Advantage of Employer Benefits

Some employers offer basic group life insurance coverage as part of their benefits package, even to young employees without dependents. These employer-sponsored plans may provide a basic level of coverage, usually at a relatively low cost.

While this basic coverage likely won’t be enough to address all your potential needs, it can serve as a foundation for future needs or offer valuable peace of mind. This is a great way to start FPU and get ahead of the curve on your finances.

Locking in Lower Premiums

One of the most compelling arguments for getting life insurance at a young age is the cost savings. The younger and healthier you are, the lower your premiums will be.

Getting coverage while you’re young locks in these lower rates for the duration of your policy term. For example, you could lock in lower premiums with Term Life insurance coverage. You may even qualify for discounts from some insurance companies.

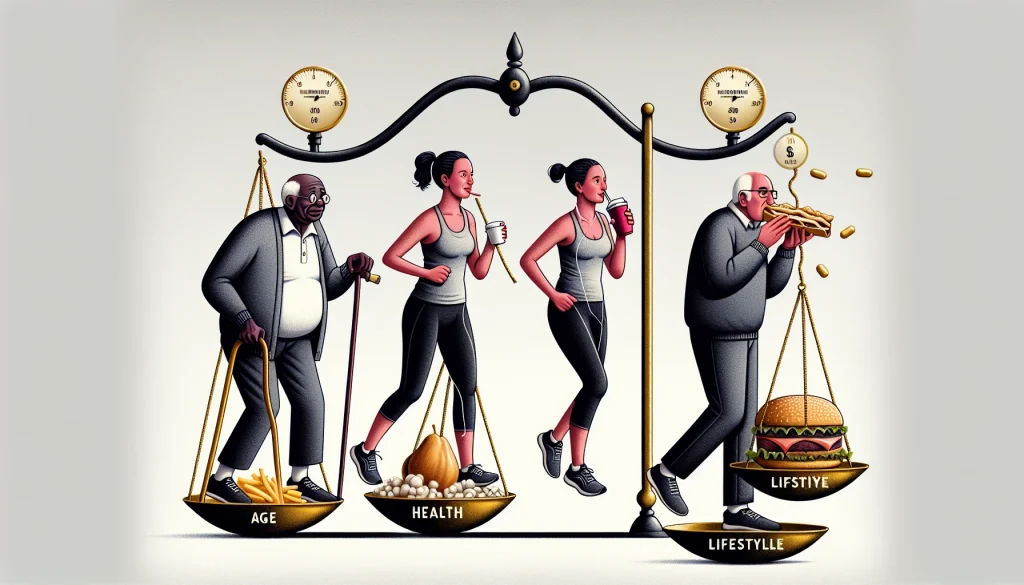

Evaluating Your Financial Position

Deciding if life insurance is right for you requires carefully reviewing your current circumstances. If you are 18 years old with no debt or dependents, these considerations become particularly relevant as your needs are different from those of someone with a family and a mortgage. Here are some steps to guide your decision:

- Calculate your net worth: Add up your assets—things like savings, investments, or a car—and subtract your liabilities—such as student loans or credit card debt. A positive net worth provides more flexibility to make financial decisions, while a negative net worth might make acquiring insurance less of a priority.

- Budget for funeral costs: Research average funeral expenses in your area and consider creating a dedicated savings plan or account specifically allocated to cover these future costs. You can use a budget app like EveryDollar to help track this.

- Talk to a financial advisor: They can provide personalized guidance, helping you explore different life insurance options if needed. Be cautious about relying solely on insurance agents, as their priority may be selling you a policy rather than providing impartial financial advice. You may also want to look into advisory groups or executive coaching to get help with your specific needs.

Conclusion

You’re young, financially free, and no one’s counting on you – but do you still need life insurance? Your personal circumstances hold the answer. The young and financially unencumbered have a unique advantage when it comes to choosing their coverage. Without the weight of dependents or outstanding debts, they’re free to consider their own needs and priorities.

Factors to weigh heavily include funeral expenses, the possibility of future debts like student loans, and employer-provided life insurance options. Break it down: your financial standing today, and where you’re headed. This is a personal decision, one that requires honestly acknowledging that your goals and aspirations will evolve over time – and that’s okay.

As an 18-year-old, you might be asking yourself, “Do I really need life insurance?” The truth is, it all boils down to your financial stability, your expectations for the future, and how you’d want your loved ones taken care of if something were to happen. If taking care of those “just in case” scenarios provides you with peace of mind, then obtaining coverage even with minimal financial obligations might make sense.

However, if your current focus leans toward maximizing savings and managing everyday expenses, then allocating your funds elsewhere and revisiting life insurance down the road when your circumstances might require it could be a prudent financial move. You can build wealth now and revisit life insurance later.

FAQs about if you are 18 years old with no debt or dependents do you need life insurance? why?

Do you need life insurance if you are 18 with no debt or dependents?

Typically, at 18 with no debt or dependents, you may not need a large life insurance policy as there is no one financially relying on you. However, you might want to consider a small policy for funeral expenses to avoid burdening family.

Should an 18 year old have life insurance?

Whether or not an 18-year-old *should* get life insurance depends. If they have no debts or dependents, it’s less crucial but a small policy for final expenses can be considered. Factors like family history, potential for future debts, and whether they want to lock in lower premiums while young play a role in this decision. Talking to a financial advisor can help make this decision.

Do I need life insurance if I have no dependents?

If you don’t have dependents who rely on your income, life insurance is less critical. But even without dependents, it can help cover debts you leave behind, such as a mortgage or private student loans, so your family isn’t stuck paying for them. If this isn’t a worry and you have savings to cover final expenses, you may not need life insurance.

Should I have life insurance if I have no debt?

If you have no debt, it’s less crucial to cover financial obligations, but consider what financial burdens your death might place on your family. They may have to cover your funeral expenses or potential future costs if you were to have children later on. Evaluate these factors alongside your financial situation to make the best decision for you.