Navigating the what and why of buy-sell agreements is essential for any business owner. Simply put, a buy-sell agreement, or “what is a buy-sell agreement,” is a binding roadmap that directs what happens to an owner’s interest when specific, often unforeseen, events occur—like the decision to exit the business or an owner’s untimely passing.

This guide will help you understand the buy-sell agreement’s pivotal role in safeguarding your business’s future, ensuring orderly transactions, and minimizing disputes during transitions.

Table of Contents

Key Takeaways

Buy-sell agreements are critical contracts for reassigning ownership in a business, helping to ensure stability and continuity by outlining clear terms for ownership transfer in the event of an owner’s exit, death, or other triggering events.

There are several types of buy-sell agreements, including entity-purchase, cross-purchase, and wait-and-see, each with distinct mechanisms and implications for how an owner’s interest is bought out and funded, with consideration for tax and legal outcomes.

Effective buy-sell agreements require careful planning, including valuation methods and funding options, and should be regularly reviewed and updated to reflect changes in the business, legal requirements, and market conditions for continued relevance and fairness.

Breaking Down Buy-Sell Agreements

Often referred to as a “business prenup,” a business buy-sell agreement is a contract that provides a plan for the reassignment of a business owner’s interest in the company.

Deployed by various business entities, including limited liability companies, partnerships, and sole proprietorships, buy-sell agreements are indispensable for maintaining business continuity. They outline a clear path for the reallocation of an owner’s share to the remaining business partner or even the company itself in the event of an owner’s death or decision to exit the business.

Without such an agreement, a former business partner’s spouse could inadvertently become a co-owner, emphasizing the importance of these agreements in preventing such unintended scenarios.

But how exactly does a buy-sell agreement work? And what makes it so crucial for business owners? To answer these questions, we must delve deeper into the nature and components of these agreements.

Definition and Purpose

A buy-sell agreement serves dual roles, acting as both a premarital agreement and a will for businesses. It outlines the division of business assets and ownership under a variety of circumstances, much like a prenup does for personal assets in a marriage.

The primary aim of a buy-sell agreement is to prevent an owner from selling their interests to an outsider without the other owners’ consent, thus ensuring a smooth transition of ownership during events such as partner retirement, death, or exit from the business.

Moreover, a buy-sell agreement:

Sets clear terms and conditions for business partners to follow in the event of a split

Reduces the risk of financial disputes

Ensures an orderly transition of ownership

It serves as an exit strategy for business owners, eliminating potential conflicts during ownership transfer events, which some may call “buy-sell agreement spells.”

Key Components

Like the gears in a machine, various components work together to make a buy-sell agreement effective. These include:

Triggering events, such as death, disability, divorce, insolvency, termination of employment, or retirement, which necessitate governance provisions for an orderly ownership transfer.

Conditions are set within the agreement to prevent undesirable individuals, like ex-spouses or heirs, from obtaining ownership stakes.

Outline of the procedure for owner removal.

Valuation is another vital aspect of a buy-sell agreement. An explicit fair market value clause ensures that the transfer of shares is equitable and corresponds with the true worth of the business. Considerations such as the equity stakes of each owner, the implications of share purchases, and the business valuation methods must be carefully weighed.

All these elements fortify the agreement, making it a fundamental tool for business continuation and ownership transitions.

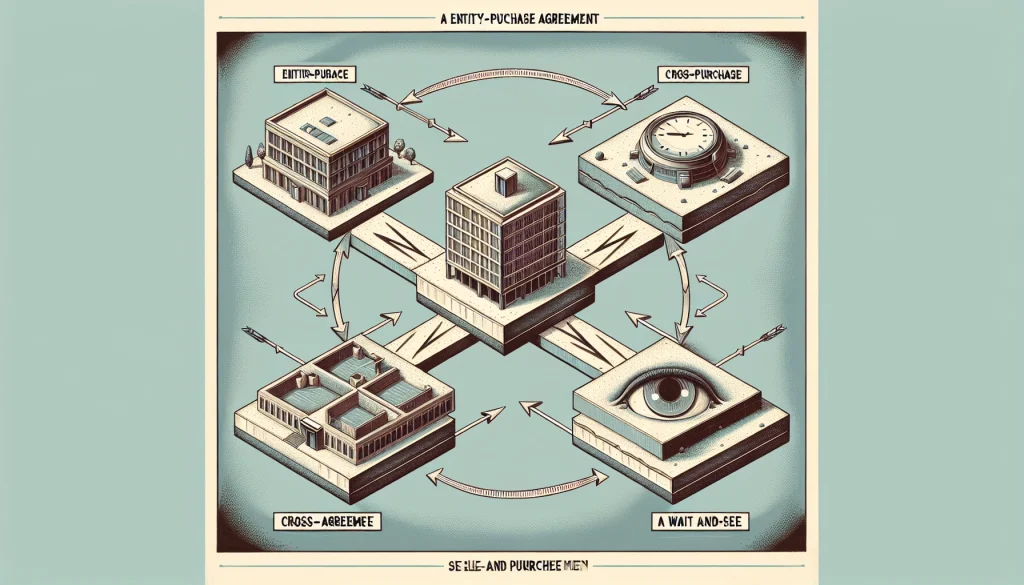

Types of Buy-Sell Agreements: A Comparative Analysis

Buy-sell agreements are not one-size-fits-all. They come in various shapes and sizes, each fitting different business structures and needs. Before you sign buy-sell agreements, it’s important to understand the three common forms:

Entity-purchase agreement: the business entity purchases the departing owner’s interest.

Cross-purchase agreement: the remaining partners buy the departing partner’s share.

Wait-and-see agreement: a hybrid type where the buyer can be either the business entities or the individual partners, decided after the triggering event.

Understanding these different types of agreements is crucial for choosing the one that best suits your business needs. Let’s take a closer look at each.

Entity-Purchase Agreement

An entity-purchase agreement is a contract between the business entity and its owners. It outlines the terms of the buyout on events like death or disability, thereby safeguarding the interests of both departing owners and the business. Such agreements are often funded through life insurance policies, with the business as the beneficiary, to ensure a smooth financial transition during the buyout of an owner’s share after their demise.

While the simplicity and easier administration of these agreements are appealing, they do have potential downsides. These include potential adverse tax consequences for the remaining owners and alignment issues with all business interests. As with all legal agreements, due diligence and compliance with applicable laws and regulations are paramount. It is important to seek legal or tax advice to ensure the best outcome for all parties involved.

Cross-Purchase Agreement

In a cross-purchase agreement, the surviving owners are obliged to buy the interest of a departing owner after certain triggering events, at a pre-determined price. To fund the purchase of shares in the event of an owner’s death, each business owner holds life insurance policies on the other remaining owners, with themselves as beneficiaries.

This type of agreement offers tax benefits, as the purchase of a departing owner’s ownership interest increases the basis for the remaining owners, potentially reducing capital gains when the stock is later sold. However, it’s not all smooth sailing. Potential pitfalls include:

unequal premium payments due to age or health differences among owners

risk of proceeds being used inappropriately

greater complexity in administration, particularly when multiple owners are involved.

Wait-and-See Agreement

A wait-and-see buy-sell agreement offers a degree of flexibility that the previous two types lack. Under this agreement, the business entity can defer the decision to purchase any interest until the triggering event occurs.

This means the obligation to purchase doesn’t arise until after the triggering event, providing flexibility in funding the departing owner’s share purchase.

One significant advantage of a wait-and-see agreement is its capacity to minimize conflict and ensure a smooth transition by delaying the determination of who will buy the shares until it’s necessary to do so.

However, it can also create uncertainty, as the party that will ultimately buy the shares isn’t decided until the triggering event occurs, which could lead to tension among remaining owners.

Crafting an Effective Buy-Sell Agreement

Crafting a buy-sell agreement is like creating a roadmap for your business’s future. It requires precision, foresight, and an understanding of how businesses work. An effective agreement must include:

A clear description of how an owner’s interest will be sold

The agreed-upon amount for the sale

Input from professionals to minimize future ownership disputes and ensure a smooth transition.

A well-drafted buy-sell agreement is instrumental in fostering a positive transition process and reducing familial challenges for family businesses. Let’s delve into the specifics of crafting an effective agreement.

Establishing Valuation Methods

Establishing valuation methods in a buy-sell agreement is a bit like setting the rules of a game. It helps determine the business’s fair market value and prevents disagreements during buyouts. The agreement might include:

An agreed-upon fixed price

An independent appraisal

A market comparison with similar companies

Formulas based on the business’s assets or earnings

Discounted cash flow analysis is often used to calculate the present value of projected cash flows, thereby establishing the worth of the target entity. These methods manage ownership changes and can be employed for situations like dispute resolution over a company’s value or a partner’s share.

Funding Options

Funding a buy-sell agreement can be done in several ways, including:

Utilizing life or disability insurance

Using installment notes

Using cash reserves

Selling or distributing non-essential company assets

These options ensure a smooth financial transition during the implementation of the agreement.

Life insurance is a common funding method, providing the necessary capital for purchasing a deceased owner’s interest. In the case of a cross-purchase agreement, it offers a tax-free payout and protection from creditors.

To streamline the process and reduce the number of policies needed, an Insurance LLC can be created for owning the life insurance policies required in a buy-sell agreement.

Legal Considerations

Legal considerations are the guardrails of a buy-sell agreement, ensuring its validity and compliance. A comprehensive buy-sell agreement must be compliant with current laws and address events like an owner’s retirement, death, or incapacity to ensure legal validity.

Professional guidance is essential in crafting a legally binding agreement that complies with all applicable laws and regulations.

Dispute resolution mechanisms, such as arbitration or mediation, are also included in a buy-sell agreement to handle any disagreements that may arise.

Transactions among family members in a buy-sell agreement may attract IRS scrutiny, therefore, adherence to rules and careful planning are required to withstand IRS examination.

Implementing and Updating Your Buy-Sell Agreement

Implementing a buy-sell agreement is like setting sail on a well-planned journey. It’s about putting all your carefully drafted plans into action. But the journey doesn’t end once the agreement is implemented. For the agreement to remain relevant, it should be periodically reviewed and updated to reflect current circumstances and plans.

Let’s explore the process of implementing and updating a buy-sell agreement in more detail.

Implementation Process

Implementing a buy-sell agreement involves a series of steps. For LLCs, the agreement may be integrated within the operating agreement or set as a separate document, depending on preference.

It’s also important to ensure that ownership certificates include a legend reflecting the transfer restrictions dictated by the agreement.

Creating a clear and detailed succession plan is an integral part of crafting an effective buy-sell agreement. This involves:

Identifying successors

Outlining the transition process

Specifying the stakeholders

Determining trigger events for a buyout

Establishing the current business valuation

Defining the structure for buying or selling an interest

A well-crafted implementation process will ensure a smooth transition and protect the interests of all parties involved.

Regular Review and Updates

Just like a car needs regular maintenance to keep running smoothly, a buy-sell agreement requires regular reviews to ensure that it continues to serve the business operations effectively.

Changes in the business or its environment may necessitate updates to the agreement.

Specifically, updating the valuation provisions of a buy-sell agreement is crucial to accurately reflect the business’s current value.

This ensures that the agreement remains fair and relevant, regardless of changes in market conditions or the business’s performance.

Summary

After our deep dive into the world of buy-sell agreements, it’s clear that these contracts are more than just a legal necessity. They are a business tool, a roadmap, a compass, and a safety net all rolled into one. Whether it’s an entity purchase, cross-purchase, or wait-and-see agreement, a well-crafted buy-sell agreement ensures smooth ownership transitions and business stability.

As a business owner, your role doesn’t end with drafting and implementing a buy-sell agreement. Regular reviews and updates are crucial to ensure that the agreement remains relevant and effective. Remember, a buy-sell agreement is not a set-it-and-forget-it document. It’s a living, breathing part of your business that evolves with time and needs your attention to continue serving its purpose effectively.

Frequently Asked Questions

What is a buy-sell agreement?

A buy-sell agreement is a crucial legal contract that facilitates smooth ownership transitions and ensures business stability by detailing the reassignment of a business owner’s interest in the company.

What are the three main types of buy-sell agreements?

The three main types of buy-sell agreements are entity-purchase, cross-purchase, and wait-and-see agreements. Each type has its own unique features and benefits.

How is a buy-sell agreement funded?

A buy-sell agreement can be funded through options like life or disability insurance, installment notes, cash reserves, or the sale of non-essential company assets. These funding options provide financial security and stability for the agreement.

What are the key legal considerations in a buy-sell agreement?

When creating a buy-sell agreement, it is crucial to consider compliance with current laws, incorporate dispute resolution mechanisms, and plan carefully to withstand IRS scrutiny. These factors are key in ensuring the agreement’s legal soundness.

How often should a buy-sell agreement be reviewed and updated?

A buy-sell agreement should be periodically reviewed and updated to ensure it continues to serve the business’s objectives effectively. It is important to accurately reflect the current value.