Have you ever wondered, “What life insurance is used for” exactly? Well, you’re not alone. It’s a question many people ponder, maybe even feel a bit embarrassed to ask. But, the truth is, life insurance is a cornerstone of solid financial planning, and understanding its uses is important. It’s a powerful tool designed to provide financial security for your loved ones after you’re gone, offering them a financial safety net during a difficult time.

But here’s the thing—what is life insurance used for, aside from the obvious? It’s not just about covering funeral expenses. It goes way beyond that.

Table Of Contents:

- How Life Insurance Works

- Understanding the Many Uses of Life Insurance

- Exploring Different Types of Life Insurance

- Conclusion

- FAQs about what is life insurance used for

What Life Insurance is Used For?

Life insurance operates on a straightforward principle: you pay premiums to an insurance company. In return, they guarantee to pay a sum of money—the death benefit—to your designated beneficiaries upon your passing. This financial cushion can help your family navigate the often-turbulent waters of financial uncertainty after a loved one passes away. Think of it as a safety net, there to catch them when they need it the most.

Understanding the Many Uses of Life Insurance

Let’s dig a little deeper into the wide range of situations where a life insurance payout can be a true lifesaver. Life insurance can provide lifetime coverage as long as premiums are paid. Let’s take a closer look at the many ways a life insurance policy can safeguard your family’s future.

Covering the Basics: Funeral Expenses and Outstanding Debts

According to the National Funeral Directors Association, in 2023 the median cost of a funeral with viewing and burial reached almost $8,000. That’s a significant expense to shoulder during an already emotionally charged time. This is why having adequate insurance coverage is so important.

And funerals aren’t the only immediate costs. What happens to your outstanding debts – credit cards, loans, mortgages – when you die? Life insurance can be used for these, ensuring your loved ones aren’t burdened with paying off what you leave behind. It can give them a clean financial slate, free from inherited debt.

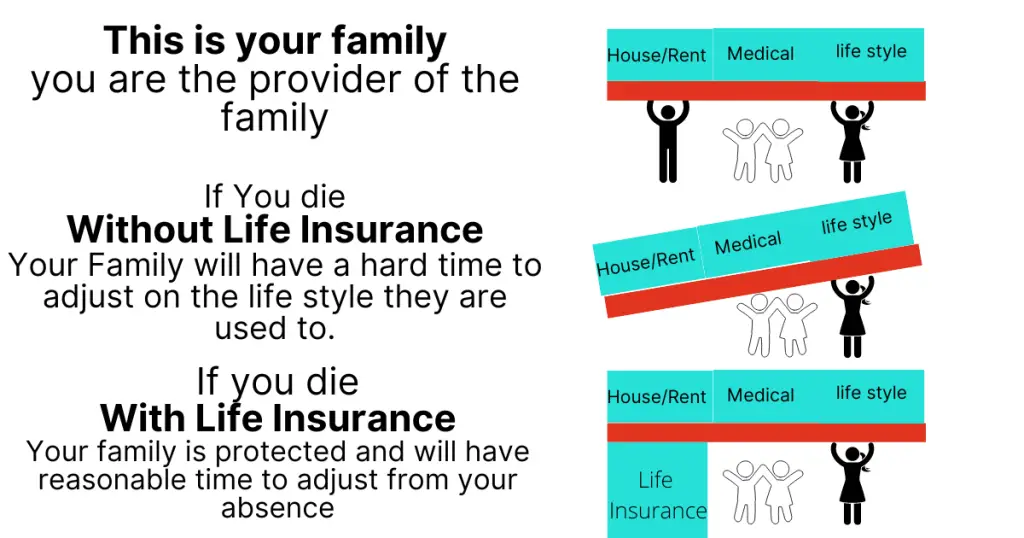

Replacing Lost Income and Maintaining Lifestyle

Imagine this – you’re the primary earner in your family. If something were to happen to you, could your family maintain their current standard of living without your income? A difficult but important question to consider.

Life insurance replaces that lost income, making sure your family can still pay bills, buy groceries, and manage daily expenses. They can focus on healing and adjusting, not scrambling for financial stability.

Funding Education: Securing Your Children’s Future

Education is a powerful gift, but its price tag can be hefty. Life insurance acts as an investment in your children’s future, ensuring their education is funded, whether it’s college or vocational training. This way, even if you’re not there physically, you’re still supporting their dreams. Life insurance companies offer a range of policies to choose from.

Let’s break down the numbers with a quick look at the average annual tuition and fees in the United States for the 2023–2024 school year, as per the College Board:

| Institution Type | Average Annual Cost |

|---|---|

| Public Two-Year (In-district) | $3,860 |

| Public Four-Year (In-state) | $10,950 |

| Private Nonprofit Four-Year | $39,400 |

As you can see, these costs can quickly add up. Including future education expenses when calculating how much life insurance to purchase ensures that you’re leaving a legacy of opportunity for your loved ones.

Leaving a Legacy: Charitable Giving

Life insurance doesn’t have to be only about practical matters. What is life insurance used for when it comes to giving back? You can designate a portion or all of your death benefit to a charity close to your heart. It’s a way to continue making a difference in the world, even after you’re gone. The policy builds cash value that can be used later on.

Exploring Different Types of Life Insurance

Choosing the right life insurance policy is crucial, and understanding the differences between life insurance policies such as term life insurance and permanent life insurance will ensure you select the coverage that best fits your needs and circumstances.

Term Life Insurance: Affordable Protection for a Specific Time Period

The name says it all: term life insurance sticks with you for a specified timeframe, usually 10, 20, or 30 years straight. You’re in control – pick up coverage for a hot minute or make it a longer-term arrangement, the choice is yours. With a clear end date, term life insurance premiums tend to be more budget-friendly compared to permanent policies that linger on. With universal variable life insurance, you get the freedom to adjust your coverage as circumstances change, thanks to its inherent flexibility.

Permanent Life Insurance: Lifetime Coverage and Potential for Cash Value

This is where things get interesting. Unlike term life, permanent life insurance remains active your entire life as long as the premiums are paid. Plus, some types, like whole life insurance, even build cash value over time. You can think of this cash value as a savings component, potentially offering opportunities to supplement retirement income or cover unexpected expenses. But this all depends on the specifics of the policy. You may even be able to skip premium payments with certain policies. Small life insurance policies have become a popular way to cover final expenses.

Conclusion

So, what is life insurance used for? It’s a multifaceted financial tool capable of offering a wide range of support for you and your loved ones. It’s about safeguarding those you cherish, leaving a lasting legacy, and facing the future with confidence, knowing that no matter what life throws your way, your loved ones will have a safety net. Whether it’s protecting your family, ensuring your business continues to thrive, or leaving a gift to your favorite charity, life insurance helps you secure your financial future and embrace what truly matters.

FAQs about what is life insurance used for

What is the purpose of life insurance?

Life insurance is intended to provide a financial safety net to your beneficiaries upon your death. It helps cover various needs like replacing lost income, paying debts and funeral costs, and achieving long-term goals like funding a child’s education. Burial costs are also something that life insurance can help cover.

Can you use life insurance for anything?

While a life insurance payout gives beneficiaries flexibility, it’s primarily for replacing lost income, covering expenses, and funding future goals. However, some policies have “living benefits,” allowing you to use funds for certain circumstances, like a terminal illness, while you’re still alive. A financial professional can help determine the best life insurance policy to fit your needs.

What does life insurance cover you for?

Life insurance typically provides a death benefit to your beneficiaries. This benefit can be used to replace income, cover funeral expenses, pay off debts (like mortgages, loans, and credit cards), fund education, contribute to a charity, or create a financial legacy.

Can life insurance be used while still alive?

Typically, life insurance is designed to pay out after your death. However, some permanent policies offer “living benefits” that can provide access to a portion of the death benefit during your lifetime. These benefits may be accessible if you experience certain qualifying events like terminal or chronic illnesses, but it ultimately depends on the specific terms outlined in your policy.

How does life insurance help with estate planning and taxes?

Life insurance plays a crucial role in estate planning, especially for high-net-worth individuals who may face significant estate tax liabilities. In 2025, estates valued over $13.99 million for individuals ($27.98 million for married couples) are subject to federal estate taxes of up to 40%, and these taxes must typically be paid within nine months of death. Life insurance provides immediate liquidity to pay these estate taxes without forcing your heirs to quickly sell illiquid assets like businesses, real estate, or investments at potentially unfavorable prices. The death benefit from a life insurance policy is generally paid income tax-free to beneficiaries, making it an efficient way to provide funds for tax payments. For even greater tax efficiency, many wealthy individuals establish an Irrevocable Life Insurance Trust (ILIT), which owns the policy and keeps the death benefit proceeds out of the taxable estate entirely. Life insurance is also valuable for business succession planning, funding buy-sell agreements to allow surviving business partners to purchase a deceased owner’s shares without creating a liquidity crisis. Beyond tax planning, life insurance can equalize inheritances among heirs—for example, leaving the family business to one child while providing equivalent value through life insurance to other children who aren’t involved in the business. Even if your estate is currently below the exemption threshold, life insurance provides protection against future tax law changes, as the exemption amount has changed significantly many times over the past decades and is scheduled to potentially drop in 2026. Estate planning with life insurance requires careful coordination with estate attorneys and financial advisors to ensure policies are properly structured and beneficiaries are correctly designated.